-

2022-2023

President Biden released his FY2023 Budget Proposal requesting $71.9 billion for the Department of Housing and Urban Development (HUD), about $6.2 billion more than what was enacted in the FY2022 spending bill. The administration seeks significant increases in funding to expand rental assistance and increase affordable housing supply and opportunity for homeownership. However, it also proposes funding levels for some key programs that would represent a decrease from their FY22 levels.

The President’s budget also proposes creating a Housing Supply Fund, a new $35 billion mandatory program to provide resources for State and local housing finance agencies and their partners to provide grants, revolving loan funds and other streamlined financing tools. This includes $10 billion in grants to advance State and local jurisdictions’ efforts to remove barriers to affordable housing development, including funding for housing-related infrastructure

Mandatory spending includes entitlement programs, such as Social Security and Medicare while discretionary spending is subject to annual fluctuations determined by Congress. Moving funding for affordable housing to the mandatory side of the budget has been a longtime policy priority for NYHC. We are excited to see the administration embracing this approach and hope it signals a true long term commitment to addressing the affordable housing crisis.

Rental Assistance: The bill proposes $15 billion for Project Based Rental Assistance and $32 billion for Tenant Based Rental Assistance. $1.6 billion is for incremental vouchers for 200,000 additional households, including those who are experiencing or at risk of homelessness or fleeing or attempting to flee domestic violence, dating violence, sexual assault, stalking, or human trafficking.

This represents a major increase from the $200 million to expand vouchers to 25,000 households in the FY22 enacted budget and would be a major down payment towards universal rental assistance.

Public Housing: The bill funds public housing operating at $5.06 billion, a $4 million decrease from the FY22 enacted budget. $3.72 billion is requested for public housing capital, which includes: $3.2 billion for the Capital Fund, $300 million to improve energy or water efficiency or climate resilience, $60 million to prevent and mitigate other housing-related hazards, such as fire safety and mold, $40 million for emergency capital needs and $25 million to address lead-based paint hazards.

While there is a small decrease in the proposed operating budget for public housing, it would also go to about 25,000 fewer public housing units requiring formula funding between FY2022 and FY2023 due to PHAs utilizing tools such as RAD. It is unclear at this stage how it would impact operating funding for NYCHA.

Low-Income Housing Tax Credit (LIHTC): The budget proposes a change to LIHTC to allow allocating agencies to give nongeographic basis boosts to bond-financed affordable housing if it is required for financial feasibility. For more details on this proposal see analysis from Novogradac.

Key HUD Programs: The bill proposes $3.8 billion for the Community Development Block Grant (CDBG) program, including $195 million to spur equitable development and the removal of barriers to revitalization in 100 of the most underserved neighborhoods in the United States.

$1.95 billion is proposed for the HOME Investments Partnerships program (HOME), an increase of $450 million from the FY22 enacted budget. The administration estimates over time this funding will result in the production of approximately 41,000 units of affordable housing and support over 15,000 low-income households with tenant-based rental assistance. This request includes a $100 million set-aside for a FirstHOME Downpayment initiative to expand homeownership opportunities for first-generation and/or low wealth first-time homebuyers.

Additionally, the budget requests $15 million in credit subsidy for a new Home Equity Accelerator Loan (HEAL) Pilot program. The HEAL program would offer new loan products to increase access to homeownership and facilitate faster accumulation of home equity for first-generation and/or low-wealth first-time homebuyers.

$966 million is requested for the Section 202 Housing for the Elderly program and $287 million for the Section 811 Housing for People with Disabilities program. These are decreases of $67 million and $64 million from FY22 respectively.

The budget proposes $3.6 billion for Homeless Assistance grants an increase of $363 million over FY22. This funding would support more than 25,000 additional households, including survivors of domestic violence and homeless youth. Of this, $82 million would be set aside for additional Youth Homelessness Demonstration Programs (YHDPs).

While we hope to see a normal appropriations process this year, often Congress misses deadlines and passes continuing resolutions with flat funding, particularly in election years. We will continue to advocate for the greatest possible investment in affordable housing both in appropriations and in any reconciliation bill that moves forward.

Read a detailed analysis from NLIHC here.

-

2021-2022

President Joe Biden released his first skinny budget in April. The 2022 discretionary request includes $68.7 billion for HUD, a $9 billion or 15% increase from the 2021 enacted level. Housing priorities are linked to goals of tackling climate change, racial justice and inclusive economic growth.

The request communicates a strong commitment to housing. However, we will withhold our analysis until more details on both his FY22 budget proposal and infrastructure plan are released. Both are expected later in April.

Here is a summary of the request:

- Expands Housing Choice Vouchers to 200,000 Additional Families. The Housing Choice Voucher program currently provides 2.3 million low-income families with rental assistance to obtain housing in the private market. The discretionary request proposes $30.4 billion, a substantial increase of $5.4 billion over the 2021 enacted level, to maintain services for all currently assisted families and expand assistance to an additional 200,000 households, prioritizing those who are homeless or fleeing domestic violence. This funding also includes mobility-related supportive services to provide low-income families who live in racially and ethnically concentrated areas of poverty with greater options to move to higher-opportunity neighborhoods.

- Makes Significant Investments to End Homelessness. To prevent and reduce homelessness, the 2022 discretionary request provides $3.5 billion, an increase of $500 million over the 2021 enacted level, for Homeless Assistance Grants to support more than 100,000 additional households, including survivors of domestic violence and homeless youth. These resources would complement the $5 billion for emergency housing vouchers provided in the American Rescue Plan Act of 2021, which will also assist those who are homeless and at-risk of homelessness.

- Modernizes and Improves Energy Efficiency, Resilience, and Safety in HUD- Assisted Housing. HUD-supported rental properties collectively provide 2.3 million affordable homes to low-income families. The discretionary request not only fully funds the operating costs across this portfolio, but also provides $800 million in new investments across HUD programs for modernization and rehabilitation aimed at energy efficiency and resilience to climate change impacts, such as increasingly frequent and severe floods. These retrofits would help lower the costs and improve the quality of public and HUD-assisted housing while creating good-paying jobs. In addition, the request includes $3.2 billion for Public Housing modernization grants, an increase of $435 million above the 2021 enacted level.

- Increases the Supply of Affordable Housing. To address the critical shortage of affordable housing in communities throughout the Nation, the discretionary request provides a $500 million increase to the HOME Investment Partnerships Program, for a total of $1.9 billion, to construct and rehabilitate affordable rental housing, and to support other housing-related needs. This is the highest funding level for HOME since 2009. In addition, the request provides $180 million to support 2,000 units of new permanently affordable housing for the elderly and persons with disabilities, supporting independent living for seniors and people with disabilities.

- Invests in Affordable Housing in Tribal Communities. Native Americans are seven times more likely to live in overcrowded conditions and five times more likely to have plumbing, kitchen, or heating problems than all U.S. households. The discretionary request helps address poor housing conditions in tribal areas by providing $900 million to fund tribal efforts to expand affordable housing, improve housing conditions and infrastructure, and increase economic opportunities for low-income families.

- Spurs Infrastructure Modernization and Rehabilitation in Marginalized Communities. The discretionary request provides $3.8 billion for the Community Development Block Grant program, which includes a targeted increase of $295 million to incentivize communities to direct formula funds toward the modernization and rehabilitation of public infrastructure and facilities in historically underfunded and marginalized communities facing persistent poverty.

- Reduces Lead and Other Home Health Hazards for Vulnerable Families. The discretionary request provides $400 million, an increase of $40 million, for State and local governments and nonprofits to reduce lead-based paint and other health hazards in the homes of low-income families with young children. The Centers for Disease Control and Prevention identifies the risk for lead exposure as greatest for children from racial and ethnic minority groups and children in families living below the poverty level, and the Lead Hazard and Healthy Homes grants target interventions to these most at-risk communities.

- Supports Access to Homeownership and Pandemic Relief. The discretionary request supports access to homeownership for underserved borrowers through the Federal Housing Administration’s (FHA) mortgage insurance programs. FHA is a crucial source of mortgage financing for first-time and minority homebuyers, who accounted for 83 percent and 37 percent, respectively, of FHA home purchase loans in 2020. In addition, through its expanded and streamlined loss mitigation program, FHA continues to provide urgent relief to homeowners suffering financially due to the COVID-19 pandemic.

- Promotes Efforts to Prevent and Redress Housing Discrimination. The discretionary request provides $85 million in grants to support State and local fair housing enforcement organizations and to further education, outreach, and training on rights and responsibilities under Federal fair housing laws. The request also invests in HUD staff and operations capacity to deliver on the President’s housing priorities, including commitments outlined in the Presidential Memorandum on Redressing Our Nation’s and the Federal Government’s History of Discriminatory Housing Practices and Policies.

We will be looking for more details on LIHTC from the Treasury Department. At present, there is just this promise of CDFI expansion.

- Invests in American Communities and Small Businesses. To support and empower the Nation’s most vulnerable communities, including many rural communities, the discretionary request provides $330 million, an increase of 22.2 percent above the 2021 enacted level for annual appropriations, to support expanding the role of Community Development Financial Institutions (CDFIs), which offer loans to start-ups and small businesses to promote the production of affordable housing and community revitalization projects. This investment builds on an unprecedented level of support for the CDFI industry in 2021, including more than $3 billion in direct funding, $9 billion for investments in CDFIs and Minority Depository Institutions, and provisions in the American Rescue Plan Act of 2021 encouraging CDFI participation in the $10 billion State Small Business Credit Initiative.

-

2020-2021

The President’s FY21 HUD budget represents a 15% decrease in spending for critical affordable and public housing programs compared to FY20 enacted funding levels. It includes the complete elimination of several impactful and proven HUD programs and insufficient funding for existing rental assistance vouchers.

Below is a preliminary analysis of the top impacts to NYC’s affordable and public housing programs. These funding levels compare the President’s FY21 budget proposal to the FY20 enacted funding NYC received from HUD. The below figures also operate under the assumption that NYC will receive the same enacted FY20 funding from HUD for FY21.

Elimination of Public Housing Capital Fund – reflects a loss of all funding – $549 million in FY20. NYCHA and its residents are in the midst of a crisis, NYCHA needs more funding not less to make critical capital repairs.

Reduction in Public Housing Operating Fund – 10% loss of funding for day-to-day operation and maintenance of NYCHA properties compared to current funding.

More than 20% decrease in Section 8 Contract Renewals – based on current funding levels, proposal could lead to a loss of approximately 9,000 existing vouchers from HPD and NYCHA programs in NYC and an additional 600-700 vouchers administered by NYS HCR in the five boroughs.

Elimination of Community Development Block Grants – Loss of $167M for NYC compared to current funding. Last year, HPD used approximately $130M in CDBG funds to enforce housing quality standards, including code inspections, emergency repairs, housing litigation, and emergency shelter.

Elimination of HOME Investment Partnerships Program – Loss of $70M for NYC compared to current funding. Last year, HPD used these funds for new construction of special needs housing (including seniors), down payment assistance, and rental assistance for homeless families.

Elimination of the VASH program, Family Unification Program, and the Mobility Demonstration.

For additional housing program funding levels, please see NLIHC’s comprehensive budget chart.Harmful Policy Provisions

Making Affordable Housing Work Act – Trump reintroduces his dangerous rent reform proposal for HUD-assisted households that the NYHC has fought hard against since he first proposed the idea in 2017. It would lead to dramatic rent increases for some of the most vulnerable New Yorkers. Public Housing residents, who are non-elderly or disabled, would face up to a 40% rent increase. Section 8 voucher holders who are non-elderly or disabled would see an average rent increase of 20%.While Congress has rejected the President’s budget cut proposals in previous years, with NY’s current homeless and affordable housing crises, we cannot afford to be complacent! NYHC will continue to fight for adequate HUD funding levels and against dangerous policy proposals, but Congress must also hear from you about the importance of HUD programs in your community or to your organization and how cuts would hurt vulnerable and low-income NYers!

-

2019-2020

President Trump’s FY 2020 budget proposal entitled “A Budget for a Better America: Promises Kept. Taxpayers First” was released today highlighting the Administration’s top priorities, of which housing definitely is not one. This budget includes $2.7 trillion in spending cuts—higher than any other administration in history and reduces non-defense discretionary spending. The administration requests $44.1 billion in funding for HUD’s Budget, which represents a 18% cut from the enacted FY 2019 budget. If enacted, this budget would seriously harm HUD-assisted households and severely damage affordable and public housing programs in New York and across the country.

SETTING NYCHA UP TO FAIL

Only one month after HUD reached a settlement agreement with NYCHA, in which the City of New York commits more than $2 billion, the Trump Administration audaciously proposes the complete elimination of public housing capital funds. The Administration is effectively divorcing itself of its responsibility to fund the maintenance and repair of public housing and proposes moving to rental assistance platforms like RAD to leverage private financing. However, it is not a real plan with only a paltry $100 million in RAD funding and not enough Section 8 to even maintain current use. Additionally, the budget requires that RAD funding must be prioritized for redevelopment use in Opportunity Zones, which will have limited use in New York City. Despite HUD’s Regional Administrator Lynne Patton’s spotlight on conditions during her month stay in NYCHA housing and her introduction of President Trump to Frederick Douglass Houses Tenant Association President Carmen Quiñones, this budget completely fails public housing residents. It also sets NYCHA and its new monitor up to fail. It is impossible for NYCHA to meet substantial compliance with federal regulations relating to health and safety outlined in the settlement agreement without a substantial and sustained increase in funding from all levels of government.

HUD BUDGET

With $8.7 billion in proposed cuts, the President’s attack on low-income households continues with reissued proposals for work requirements and rent reforms in the Making Affordable Housing Work Act (MAHWA). These proposals would increase rent for thousands of HUD-assisted households. Despite the contradiction, Secretary Carson top budget priorities include 1) Increasing rent assistance (although the budget cuts it); 2) Continuing homeless grants (also cut); 3) Removing lead and health hazards from homes (slight increase but wildly insufficient funding); 4) A 5-year “Financial Transformation” plan and meeting critical staffing needs (lowest staffing levels reached under his leadership) and lastly 5) “The Prescription for HUD” focused on economic opportunity and streamlining HUD processes (Envision Centers rebrand existing programs). Check out NLIHC’s budget chart for a full comparison to FY2019 funding levels. Here are some HUD budget highlights worth noting:

- Public housing capital funding is eliminated and operating funds cut by ~40%.

- CDBG, HOME, Choice Neighborhoods, Self-Help and Assisted Homeowner-ship Opportunity Program are all eliminated.

- Section 8 is cut by $354 million, which means fewer vouchers to combat homelessness and insufficient Tenant Protection Voucher funding to meetNYCHA’s conversions needs.

- Homeless Assistance Grants are slightly decreased.

- While the budget boasts ~$60 million proposed increase for the mitigation of lead-based paint and other hazards in low-income homes, that number is based on the President’s FY2019 proposed budget and not the actual budget enacted by Congress. When compared to the actual enacted budget of FY2019, the proposed increase is only a mere $11 million extra nationwide.

- Opportunity Zone Technical Assistance Funding is new for local municipalities that are seeking to attract public and private investments to their communities. This is something to watch as aligning HUD programs with OZones can be potentially be problematic in a state like New York with a robust affordable housing pipeline.

- HUD’s staffing levels have declined over the last four decades from a high of almost 18,000 full-time equivalents (FTEs) in 1977 to fewer than 7,600 FTEs in FY 2018, while its budget authority has steadily increased from just under $30 billion to more than $50 billion. Surprisingly, the President’s Budget allocates $1.6 billion toward salaries and expenses (S&E), almost $56 million above the 2019 Annualized CR level. This funding will enable HUD to increase its staffing to nearly 7,800 FTEs.

- FHA lender enforcement program and down-payment assistance practices reform legislative proposals are expected to be forthcoming.

OTHER FEDERAL PROGRAMS

- The budget reduces the USDA budget by 15%.

- Eliminates Community Development Financial Institutions (CDFI) Fund discretionary grant and direct loan programs.

- The president once again pushes for work requirements across all safety-net programs and proposes substantial changes to Temporary Assistance to Needy Families which would impact homeless families and NYC’s shelters.

- The President has called upon the Congress to pass legislation that generates at least $1 trillion in infrastructure investment. His infrastructure proposal last year was described by CBPP as a “mirage”.

NEXT STEPS

President Trump’s budget will cost New York State at least $1 billion and hurt low-income families. As in prior years, we expect Congress will fully reject the President’s proposal. NYHC will be advocating against these cuts and will produce more detailed analysis of impact on New York housing programs in the next weeks and as Congress unveils their spending bills.

-

2018-19

Congress and the President were able to pass a FY 2019 budget bill package to avoid another costly and dangerous government shutdown. The FY 2019 HUD and USDA spending bills needed to fund programs through September were included in the package. The strong Congressional support for HUD programs in last year’s spending bill has been maintained into FY 2019 HUD budget. The HUD budget was increased by $1.5 billion, while USDA Rural Housing programs saw relatively flat funding.

Here are some HUD and USDA key highlights:- New Mobility Demonstration Program: $25 million for a new mobility demonstration program, $5 million of which can be used to provide new housing vouchers and rest for mobility-related services to help families with children move to areas of opportunity. With HPD launching a new mobility initiative and compelling research on improved outcomes for young children, this is welcomed support.

- HUD-Veterans Affairs Supportive Housing Vouchers: $40 million for new HUD-VASH vouchers. This program has been successful in reducing and even eliminating veteran homelessness in some localities.

- Section 8: Advocates believe the budget sufficiently funds all current Section 8 vouchers and contracts. This should mean that NYCHA, HPD and HCR are all able to issue vouchers through attrition at minimum.

- Public Housing: Public Housing Operating Fund received a $103 million increase, while Public Housing Capital Fund saw a $25 million increase specifically to address lead-based paint hazards. While there was a larger increase last year, this is at least moving in the right direction.

- Community Development Block Grant: CDBG received level funding.

- HOME Investments Partnerships: HOME was cut by $11 million.

- Section 202 Housing for the Elderly: $678 million funds existing contracts and renews service coordinators, while also providing $51 million for new 202 housing and $10 million for home modifications. Last year was the first appropriations for new 202 housing since 2011. It is critical that this funding for new elderly housing continues and expands to meet growing demand.

- McKinney Vento Homeless Assistance Grants: Homeless Assistance Grants increased by $123 million.

- Family Self-Sufficiency Program: FSS received a $5 million Increase.

- Fair Housing: HUD’s office of Fair Housing and Equal Opportunity received level funding.

- No HUD Program Rent Policy Changes that had been proposed by the Administration were included in this budget.

- USDA Section 521 Rural Rental Assistance: Section 521 was cut by $23 million.

- USDA Section 515 Rural Rental Housing Loan: Section 515 received level funding.

- USDA Multifamily Preservation and Revitalization Demonstration was increased by $4.5 million.

For a more comprehensive breakdown of HUD and USDA programs please see NLIHC’s Budget Chart.

-

2017-18

As of October 1st, HUD is currently being funded via a three month Continuing Resolution (CR) that is set to expire on December 8th. The House also passed an Omnibus FY 2018 appropriations package in September, which included its Transportation Housing and Urban Development (THUD) appropriations bill, but the Senate floor has not approved its THUD appropriations bill as of yet. Currently, it is not clear whether Congress will be to reconcile the differences between the two bills and approve FY2018 appropriations legislation before December 8th or if they will have to issue a second CR. All of the federal actions that relate to the HUD budget taken this year are detailed in chronological order below starting with release of the startling Executive budget laden with steep cuts to non-defense discretionary programs this spring that led to a furious public outcry that the House and Senate Appropriations Committee heard and allayed in their approved THUD bills this summer. Subsequently, after devastating Hurricanes hit Texas, Florida and the Caribbean, a Disaster Relief Spending Package was quickly bundled and approved with a three month CR and debt ceiling extension, and then shortly after the House approved its Omnibus Appropriations package.

EXECUTIVE BUDGET

President Trump’s released a preliminary budget blueprint in March and his full budget request to Congress in May, which proposed $7.7 billion in housing cuts compared to FY 2017 levels. The budget proposed increasing defense spending by $52 billion by slashing non-defense programs such as HUD assistance, food stamps, TANF and Medicaid. It also proposed the elimination of several key housing and community development programs as well as devastating Rental Reform policy reforms. In New York alone, the President’s budget would have cut more than $1 billion in housing funds statewide. Executive Budget’s Impact on NY State:

- 26,530 households receiving Section 8 rental assistance across New York State would be at risk of homelessness.

- -$409,387,940 cuts to public housing authorities including NYCHA

- -$286,644,708 eliminated in CDBG funds across the state.

- -$91,483,440 eliminated in HOME funds for low-income rental housing

- Rent burden would be increased from 30% to 35% of tenant income in a pilot impacting 98,700 Project-Based Rental Assistance (PBRA) and 14,800 households residing in Housing for the Elderly (Section 202) and Housing for Persons with Disabilities (Section 811) in New York State. Note that average tenant income for 202 households is $13,300 annually. In these buildings, owner adjustments are frozen and utility allowances are also proposed to be eliminated.

Programs Eliminated or Unfunded

- Community Development Block Grant

- HOME Investment Partnerships

- Choice Neighborhoods

- Section 4 Capacity Building program

- Self-Help Homeownership Opportunity Program

- National Housing Trust Fund (HTF) is eliminated and Trump’s budget permits the HUD secretary to redirect these remaining resources to offset the cost of salaries, contract expenses, and technology improvements at the Federal Housing Administration (FHA).

Rental Reforms (full details are linked here)

- An increase in the tenant contribution toward rent from 30 percent of adjusted income to 35 percent of gross income. The Department does not plan to implement this provision in the Section 8 or Public Housing programs in 2018, but nonetheless requests authority for this change across core rental assistance programs. The Department will implement this provision as a pilot in Project Based Rental Assistance (PBRA), Housing for the Elderly (Section 202), and Housing for Persons with Disabilities (Section 811) in 2018. Hardship exemptions, as defined by the Secretary, will be available for tenants.

- The establishment of mandatory minimum rent of $50 per month, with hardship exemptions.

- Elimination of utility reimbursement payments to tenants, with hardship exemptions.

- For PBRA/202/811: A one-year freeze on annual rent adjustment increases.

- Ability of the Secretary of Housing and Urban Development to waive, or specify alternative requirements for, statutory or regulatory provisions related to public housing agency (PHA) administrative, planning, and reporting requirements, energy audits, income recertification, and program assessments.

- HCV program will no longer provide higher payments for enhanced vouchers. This reform would apply the same cost limitation on the maximum subsidy that may be paid under the voucher program to enhanced vouchers, but the tenant rent limitation will be waived so that families will not be required to relocate as a result of this change.

HOUSE of REPRESENTATIVES THUD APPROPRIATIONS BILL

In July, after months of public outcry against the President’s HUD budget cuts, the House Appropriations Subcommittee on Transportation Housing and Urban Development (THUD) released and approved their spending bill, which cuts HUD programs by $487 million below the fiscal year 2017 enacted level. Thanks to advocacy efforts and public pressure, the House bill’s proposed HUD cuts are drastically smaller than the president’s by $6.9 billion. However, these cuts would still have real impacts on New York families. For New York State, the cuts would mean:

- ~14,000 families using Section 8 vouchers to pay rent would be at risk of homelessness.

- $330 million decrease to NYCHA capital funding.

- NYCHA expects 2,500 residents would be impacted in 23 buildings needing boiler replacement. Another 2,250 residents would be impacted at one development that would be unable to repair brickwork causing water damage.

- 11% cut to HOME funds, which help fund supportive housing development and homeownership opportunities statewide.

- 3% cut to Community Development Block Grants, including a $6 million cut to HPD, which uses funds for Code Enforcement.

- No new HUD VASH vouchers for returning veterans. House funding only covers renewal of current vouchers.

Fortunately, none of the Executive budget’s dangerous rental reform proposals were included in the House THUD budget. While the House Appropriations bill may be better than the President’s draconian budget request, the House budget fails to provide needed federal investment in affordable and public housing. The decreases to NYCHA capital funding will continue the deterioration of public housing buildings across New York, impacting the health and well-being of residents plagued by mold. HUD cuts will also exacerbate the growing homelessness crisis in New York, as housing agencies will be unable to issue Section 8 rental assistance vouchers and will have less capital dollars to create and preserve affordable homes. Additionally, proposed cuts will impact the ability to enforce housing quality standards for all New Yorkers.

SENATE THUD APPROPRIATIONS BILL

Senate Appropriations Committee approved its Transportation, Housing and Urban Development (THUD) Appropriations bill at the end of July. The bill provides increased funding for HUD programs: $40.2 billion in HUD funding for FY 2018, $1.4 billion above FY 2017 levels and $1.94 billion more than the House THUD bill. The Senate bill includes level funding for the HOME and Community Development Block Grants after push back from mayors across the country. The Senate maintaining and even slightly increased HUD’s funding levels are a direct result of the affordable housing community and public’s tremendous advocacy efforts showing the impact of this important and critical programs. It also like the House THUD bill did not include any of the harmful Executive budget rental reform proposals. The Senate bill allocates:

- $21.365 billion for tenant-based Section 8 vouchers ($1.07 billion above the FY 2017 enacted level);

- $6.45 billion for public housing ($103.5 million above the FY 2017 enacted level); $11.5 billion for project-based Section 8 ($691 million above the FY 2017 enacted level);

- $573 million for Housing for the Elderly ($70.6 million above the FY 2017 enacted level);

- $147 million for Housing for Persons with Disabilities (nearly $1.0 million above the FY 2017 enacted level);

- $40 million for new HUD-VASH vouchers (same as FY enacted level);

- $2.456 billion for homeless assistance programs and includes $20 million for new family unification vouchers to prevent youth exiting foster care from becoming homeless.

- $55 million is provided for grants and technical assistance to test comprehensive efforts to end youth homelessness in urban and rural areas;

- $25 million for rapid rehousing assistance for domestic violence.

SHORT-TERM SPENDING AND DISASTER RELIEF PACKAGE

In the beginning of September, Congress passed a three month legislative spending package that provides funding for Hurricane relief and recovery, lifts the debt ceiling, and keeps the government funded through December 8th. The bill’s Continuing Budget Resolution extends FY 2017 levels for three months with a 0.68% across the board reduction to keep funding under the Budget Control Act (BCA) spending caps. The legislative package also provides an initial $15.25 billion in disaster spending that includes $7.4B for FEMA’s Disaster Relief Fund, $450 million in Small Business Administration disaster loans, $7.4 billion in Community Development Block Grant Disaster Recovery (CDBG-DR) funds. In addition, the legislation also includes a provision granting a necessary extension of the National Flood Insurance Program for three months, which was set to expire on September 30th, and language to provide FEMA with flexibility under the bill’s Continuing Resolution to continue to respond to Hurricanes Harvey and Irma, as well as other disasters.

HOUSE OMNIBUS APPROPRIATIONS PACKAGE

On September 14th, the House then passed its FY2018 Omnibus appropriations package entitled ‘The Make America Secure and Prosperous Appropriations Act’. It is too soon to know if the Senate will also pass an Omnibus which will have to be conferenced with the House or if a second Continuing Resolution (CR) will be passed for FY 2018. While the House funding level for HUD programs remains unchanged from the House THUD bill approved in July, there were a few notable housing amendments that were included in it:

- Section 202 Housing for the Elderly amendment to increase funding for the program by $2.5 million. The increase is offset by a $2.5 million reduction to HUD’s Office of Policy Development and Research.

- Public Housing Capital amendment to increase the public housing capital fund by $2 million. The funds would be offset by a $2 million reduction to HUD’s Information Technology (IT) Fund.

- Public Housing Operating/CDBG amendment would shift $10 million in funding from the public housing operating fund to CDBG.

- CDBG amendment to increase funding for CDBG by $100 million. The increase is offset by a $100 million reduction to HUD’s IT Fund.

- HOPWA amendment to increase funding for HOPWA by $19 million. The increase is offset by a $19 million reduction to HUD’s IT Fund.

- Section 4 Capacity Building amendment to increase funding for the program by $5 million. The increase is offset by a $5 million reduction to funds initially set aside for FHA administrative contract expenses.

- Sanctuary Cities amendment that prohibits HUD funds from being used for a State, or local government entity or official if that entity prohibits, or in any way restricts any government entity or official from sending to, or receiving from, the Immigration and Naturalization Service information regarding the citizenship or immigration status, lawful or unlawful, of any individual.

- Fair Housing Initiatives Program (FHIP) Amendment to shift FHIP funding designated for private nonprofit organizations toward state and local governments.

-

2016-17

On February 9th, President Barack Obama released his budget request for FY 2017. The President called for more than $48 Billion in 2017 spending for the U.S. Department of Housing and Urban Development (HUD), an increase of about $2B over FY 2016. Much of the proposed increase in spending would be devoted to a much welcomed new initiative to combat homelessness. There are also several new policy proposals, many supporting efforts to affirmatively further Fair Housing.

- NEW Ending Family Homelessness Effort– The President’s budget request proposes a bold new proposal to end family homelessness by 2020, building on the success of the initiative to end veteran homelessness. Through this effort, known as Opening Doors, the President challenged Congress to authorize $11B in new “mandatory” spending to serve 550,000 families over a 10 year period. As a mandatory program, the initiative would not be subject to the often contentious annual discretionary appropriations process. Specifically, the Administration is requesting $88 million for 10,000 new (incremental) Section 8 housing choice vouchers targeted to homeless families with children, as well as funding for 25,000 new permanent supportive housing units, and funds to provide 8,000 families with rapid rehousing assistance. If enacted, New York would be certain to receive a considerable increase in Section 8 vouchers given our high levels of family homelessness. Statewide, more than 80,000 New Yorkers are homeless including more than 23,000 children sleeping in shelters each night.

Other housing highlights from the President’s budget proposal are found below. For a detailed budget chart, see the National Low Income Housing Coalition’s website linked here.

- Section 8 Housing Choice Vouchers- The 2017 budget request would fully fund all expiring Tenant Based Assistance (i.e. existing vouchers). The budget also includes $10.8 billion for the Project-Based Rental Assistance program, which supports 12 months of funding for rental assistance contracts. $2.1 billion is allocated for fees to housing agencies administering Section 8, using a new evidence-based formula aiming to more accurately reflect the actual cost of running the program and to provide low-income families greater access to opportunity areas.

- NEW Housing Choice Voucher Mobility Demonstration- $15M is requested to assist households to move to areas of opportunity. In high cost cities like New York, Section 8 voucher use is primarily concentrated in low-income neighborhoods due to the limitations of Fair Market Rent levels.This is a welcomed proposal which mirrors NYHC’s policy priorities suggesting a similar program on the local level.

- Public Housing- Operating Funds would be increased slightly while Public Housing Capital Funds would be decreased. Given the tremendous capital needs of PHAs like NYCHA, this is disappointing. The Choice Neighborhoods Initiative, a signature program of this administration to revitalize neighborhoods and transform public housing, would see a substantial increase in funding from $125M in 2016 to $200M in 2017.

- RAD- The President seeks $50 million to expand the Rental Assistance Demonstration (RAD), another signature initiative of this administration to aid public housing. RAD leverages private capital for public housing through the conversion of operating funds into rental assistance. HUD also proposes to remove the 185,000 unit cap on the number of public housing units that can be preserved under RAD. Additionally, the budget proposes to make Section 202 Project Rental Assistance Contract (PRAC) owners eligible to convert their subsidy stream under RAD.

- Section 202 Elderly Housing- Funding for Section 202 Elderly Housing is increased only to cover refinancing. No funding is proposed to create any new senior housing. The federal government has not funded new senior housing for several years, which is a huge failure given current demand and anticipated population growth. According to recent LiveOn NY survey, more than 200,000 seniors are on 202 wait lists for an average of 7 years. By 2040, NYC will see a 40% increase in elderly households, rising to 1.4 million seniors.

- CDBG & HOME- Unfortunately, the request calls for a $200M cut in Community Development Block Grants (CDBG) which fund a wide variety of programs in New York and support HPD’s code enforcement activities. HOME funding would be maintained at FY 2016 levels.

- National Housing Trust Fund- In the request, HUD estimates that the National Housing Trust Fund will receive $136 million in 2017. This newly funded program support low-income rental housing and is allocated to States.

- NEW Pay-for-Success (PFS)- The budget proposes a one-time mandatory appropriation of $300 million for a new Pay for Success (PFS) fund within the Department of the Treasury which would fund state and local PFS contracts or Social Impact Bonds that are expected to save federal dollars. This could be beneficial to supportive housing or innovative MRT-type projects NYS has undertaken.

- LIHTC Income Averaging- The President’s proposal calls for Congress to authorize Low Income Housing Tax Credit (LIHTC) Income Averaging which would encourage income-mixing in projects and allow cross-subsidization to achieve deeper affordability in high-cost cities like New York. This is one of NYHC’s top priorities. Learn more about benefits for New York in NYHC analysis here.

- NEW QCT Cap Lift- A legislative proposal in this budget to remove the cap on the number of census tracts that can be designated as qualified census tracts (QCTs) would greatly benefit New York by allowing more areas to qualify for the 30% LIHTC basis boost. Until this year, all of NYC qualified for the basis boost as the entire metropolitan area was considered a difficult to develop area (DDA), which also qualifies projects for the basis boost. Currently, the population living in QCTs cannot exceed 20 percent of the population of a metropolitan area, which is problematic for dense urban areas including New York City and San Francisco.

- NEW QAP Requirement- Qualified Allocation Plans (QAPs) for tax credit allocating agencies will be required to include “Affirmatively Furthering Fair Housing” as an explicit allocation preference. While we support this policy change, it still may not be effective in driving development in many “high opportunity areas” in NYC, where land costs are prohibitively high.

- NEW Local Housing Policy Grants- The budget proposes $300 million in mandatory funds for a new Local Housing Policy Grants program. This program will provide grants to localities and regional coalitions to support new policies, programs or regulatory initiatives that create a more elastic and diverse housing supply, and in turn, increase economic growth, access to jobs and improve housing affordability.

The President’s proposals face, at best, an uncertain future given the election year and the difficulty we have seen in authorizing appropriation bills in recent years, not to mention Congress’ demonstrated desire to cut rather than increase funding for many of these programs. Ideally, the House and the Senate will take up the HUD budget request in the Spring as part of a “Transportation/HUD Appropriations Bill”. Each chamber will put forward funding bills which will then be “conferenced” to resolve any differences and a final bill will be sent to the President prior to the end of the fiscal year on September 30th. In recent years however, Congress has not been able to agree on appropriations for individual agencies and has instead passed Omnibus “Continuing Resolutions” (CRs). We will know more about what to expect in the FY2017 budget process in the upcoming months.

-

2015-16

The House passed H.R. 2577 on June 9th and the Senate passed their Transportation, Housing and Urban Development (THUD) Bill on Thursday, June 25th. These bills, still operating under sequester budget levels, do not provide the funding for affordable housing required in NY or other parts of the country struggling with housing affordability. The only hope in avoiding further cuts this federal fiscal year would be a bipartisan budget deal to end sequester spending caps. It is unlikely that we will know more about THUD funding this year until we are closer to the end of the fiscal year in September. For a comparison of select HUD programs, please see the National Low Income Housing Coalition’s FY16 Budget Chart.

Impact for New York, varies by program:

Home

HOME funds are significantly reduced from $900 million in 2015 to $767 million in the House budget (28% cut) and essentially eliminated in the Senate budget at $66 million with a 93% cut. Only 5 years ago, the City of New York received more than $100 million annually in HOME funds prior to the damaging sequester cuts. This funding for low-income rental housing is primarily used to build supportive housing for the homeless in New York. If the program is not funded at the President’s requested level of $1.06 billion, there would be a loss of an estimated 38,665 affordable housing units across the country.

Section 8 Tenant Based Rental Assistance

Section 8 Tenant Based Rental Assistance and Homeless Assistance Grants both increase very slightly in the House and Senate budgets. It is unclear if the minor increases in rental assistance funding in either bill will provide any new vouchers or just cover program renewals.

Project Based Rental Assistance

Project Based Rental Assistance is underfunded by the House and slightly increased in the Senate. Underfunding will be problematic for these existing affordable housing buildings.

Public Housing Capital

Public Housing Capital is set to decrease in both budgets (10% cut in House and 7% cut in Senate), adding to the mounting capital needs facing many public housing authorities.

Public Housing Operating

Public Housing Operating is flat in the House at $4.44 billion and only barely increased in the Senate ($4.5 billion).

Community Development Block Grants

Community Development Block Grants, funding an array of services and municipal functions in low- and moderate-income communities including code enforcement and emergency repair programs in New York neighborhoods, is maintained at $3 billion in House budget and slightly reduced in Senate.

-

2025-2026

Albany’s final budget was over a month late but with the delay came some unexpected wins for housing, strongly supported by the New York Housing Conference. In addition to new capital to support zoning reforms passed in the City of Yes for Housing Opportunity, the final budget creates a $50 million pilot Housing Access Voucher Program (HAVP) and passes the Affordable Housing Retention Act – both top legislative priorities for NYHC.

New York is in a dire housing crisis and faces an unprecedented attack on affordable housing and broader antipoverty measures from the federal government. While more is always needed, we are pleased to see Albany moving forward to keep New York’s tenants housed and think creatively about how we address existing preservation challenges.

Housing Access Voucher Program Pilot (ELFA – Part HH)

The final budget includes $50 million for a four-year pilot of the Housing Access Voucher Program (HAVP) that would provide rental assistance for individuals and families at 50% AMI or lower and experiencing homelessness or at imminent risk of losing their housing.HAVP is a huge victory for low-income renters across the state after many years of advocacy. We thank all of our partners in the Housing Access New York coalition, and WIN for their leadership on this issue. NYHC will push for permanency of this program.

Affordable Housing Retention Act (ELFA – Part GG)

The final budget includes language to return the condo conversion threshold to 15 percent for certain mixed-income rental buildings in New York City with expiring affordability requirements. In exchange, the expiring affordable units would be conveyed to a qualified nonprofit and have their affordability preserved permanently, and in some cases increased while creating affordable homeownership opportunities. The bill also requires a dedicated capital fund for repairs and improvements of the affordable units.At minimum buildings must have 100 units and be built after 1996 with income-restricted rental units that are either at risk of expiring affordability restrictions or are permanently affordable but require additional support to remain viable. In some cases, the number of affordable units will be increased to ensure that at least 20% to 30% of units remain income-restricted in perpetuity.

The language reinforces tenant protections under rent stabilization, eviction protections and creates a pathway for existing tenants of the income-restricted rental units to work with the nonprofit owner to carry out a tenant opportunity to purchase by creating a permanently affordable cooperative.

For a more detailed explanation of the provisions see this summary from Nixon Peabody.

NYHC supports this proposal spearheaded by Habitat for Humanity NYC & Westchester to create a vehicle to both prevent the loss of expiring affordable units and expand affordable homeownership opportunities.

Housing Supply

$1.025 Billion in Capital is provided to support the City of Yes to be programmed in the following:

- $500 million for new construction of affordable housing

- $200 million for New York City Housing Authority (NYCHA)

- $80 million for Mitchell-Lama preservation

- $50 million for a mixed-income revolving loan fund in NYC

- $50 million to the New York Housing for the Future Program for low- and moderate-income families:

- $25 million for homeownership

- $25 million for rental

- $50 million for construction or preservation of supportive housing:

- $30 million for adults, youth, or young adults leaving the criminal justice system

- $20 million for seniors

- $50 million to address lead, mold and asbestos

- $30 million for mold and asbestos remediation

- $20 million for lead abatement

- $20 million for an affordable housing relief fund to address capital needs, emergency repairs and hazardous conditions in 100 percent affordable housing

- $25 million to rehab vacant NYCHA units for occupancy.

Governor Hochul’s commitment of State funding was critical to helping secure a deal on City of Yes zoning reforms and NYHC strongly supports this funding.

Redevelopment of Underutilized Sites for Housing (RUSH) (Capital, Urban Development Corporation)

$250 million in capital funding for the RUSH program for re-developing underutilized sites on state owned land for housing.

Supporting Pro-Housing Communities (Capital & Aid to Localities)

$100 million included for a Pro-Housing Supply Fund would assist Pro-Housing Communities by addressing critical infrastructure needs related to new housing such as water and sewer upgrades.

$5.25 million in new grant funding will offer technical assistance to communities looking to design and adopt pro-housing policies.

Hundreds of communities across the state have applied for Pro Housing Communities certification. NYHC supports funding carrots (we would also support sticks for localities failing to add housing).

$50 Million Mixed-Income Revolving Loan Fund (Capital)

to spur mixed-income rental development outside of NYC.

NYHC strongly supports this funding. The final budget does not include programmatic language, but this proposal is similar in concept to a program in Maryland and a bill introduced by Senator Rachel May to establish a revolving loan fund to finance mixed-income projects.

Double New York State Low Income Housing Credits (SLIHC) (Rev – Part D)

from $15M to $30M per year through 2029.

NYHC is supportive of increasing SLIHC even further to better meet the need.

Expand New York State Historic Tax Credit (Rev – Part E)

by decoupling from the Federal credit and removing census tract eligibility requirements for affordable housing with at least a 30-year regulatory agreement. Previously the law required recipients of a state historic tax credit be the same taxpayer as the recipient of the equivalent federal credit and limited eligibility for the tax credit to census tracts at or below the state median family income.

NYHC strongly supports this change to remove barriers to affordable housing development and allow this tool to be used to bring affordable housing in higher income neighborhoods.

Increased Funding for Supportive Housing (Capital & Aid to Localities)

A $17.8 million increase to the New York State Supportive Housing Program (NYSSHP) will help preserve about 9,000 NYSSHP units that are at risk of going offline. Funding for the Homeless Housing and Assistance Program (HHAP) is increased to $153 million – up from $128 million, and the Empire State Supportive Housing Initiative (ESSHI) received a per-unit rate increase from $25,000 to $31,000 and $34,000 in the NYC metro area.

Expanding supportive housing must remain a top priority to reduce New York’s record levels ofHomelessness Comptroller DiNapoli’s recent report shows the state’s homeless population doubled in just 2 years. We are pleased to see significant increases in resources for affordable housing, though it falls short of the needs identified by the Supportive Housing Network of New York.

Maintaining Affordability

Shelter Arrears Eviction Forestallment (SAEF) (Aid to Localities)

$10 million for SAEF to continue providing emergency rental assistance grants to localities outside of NYC.

Increase Access to Insurance Captives

$5 million in funding to support nonprofit affordable housing owners join an insurance captive.

Reduce Shelter Rent Taxes for Mitchell-Lama Residents (ELFA – Part L)

To help address escalating increases in insurance, utility, and taxes, the final budget

reduces the share of local property taxes paid by Mitchell-Lama developments in NYC from 10% to 5% of the annual shelter rent or carrying charges and allows the rest of the state to opt-in to this reduction.

The financial stability of many Mitchell-Lama buildings continues to be a concern especially with growing capital improvement needs and rising operating costs. This proposal will have tax implications for NYC.

Expanding and Preserving Homeownership

Provide $50 Million for Starter Home Innovation Funding (Capital)

to support innovative approaches to homebuilding such as the use of factory-built and modular development and incentivize the building of more starter homes.

Disincentivize Bulk Purchases of Homes by Institutional Investors (Rev – Part F)

by creating a 90-day waiting period in which they cannot bid on single- and two-family homes.

The bill defines institutional investors as an entity or group that owns 10 or more single- or two-family homes, manage or receive funds pooled from investors and acts as a fiduciary with respect to one or more investors; and have $30M or more in assets. Entities that are funded by these investors would also be subject to the waiting period except for nonprofits, land banks and community land trusts. Violations would be subject to up to $250,000 in penalties.

The bill would prohibit institutional investors from claiming interest and depreciation deductions from these homes unless sold to an affordable nonprofit or individual buyer who will live there.

The bill also includes language to strengthen cease and desist zones where homeowners can opt in to prevent being solicited to sell their homes by requiring the Department of State to provide public notice to homeowners in the zone for maximum awareness. The DOS would be required to at minimum publish notice on their website and annually in a local newspaper within the area of the zone.

NYHC strongly supports these legislative changes.

Create an Affordable Homebuyer Tax Incentive (ELFA – Part K) The final budget excluded the Governor’s proposal for an opt-in homebuyer tax incentive between 25 and 50 percent of the assessed value of a real property that is sold to a low-income buyer and subject to a regulatory agreement with a governmental entity, nonprofit, land bank, or community land trust. This would create a path for localities to assess taxes that more accurately reflect the true market value of subsidized homes. However, Governor Hochul indicated she secured and agreement to address this issue and similar legislation recently passed both houses to allow an opt-in between 25 and 75 percent of assessed value, so we expect her to sign it.

Funding for Other Housing Programs

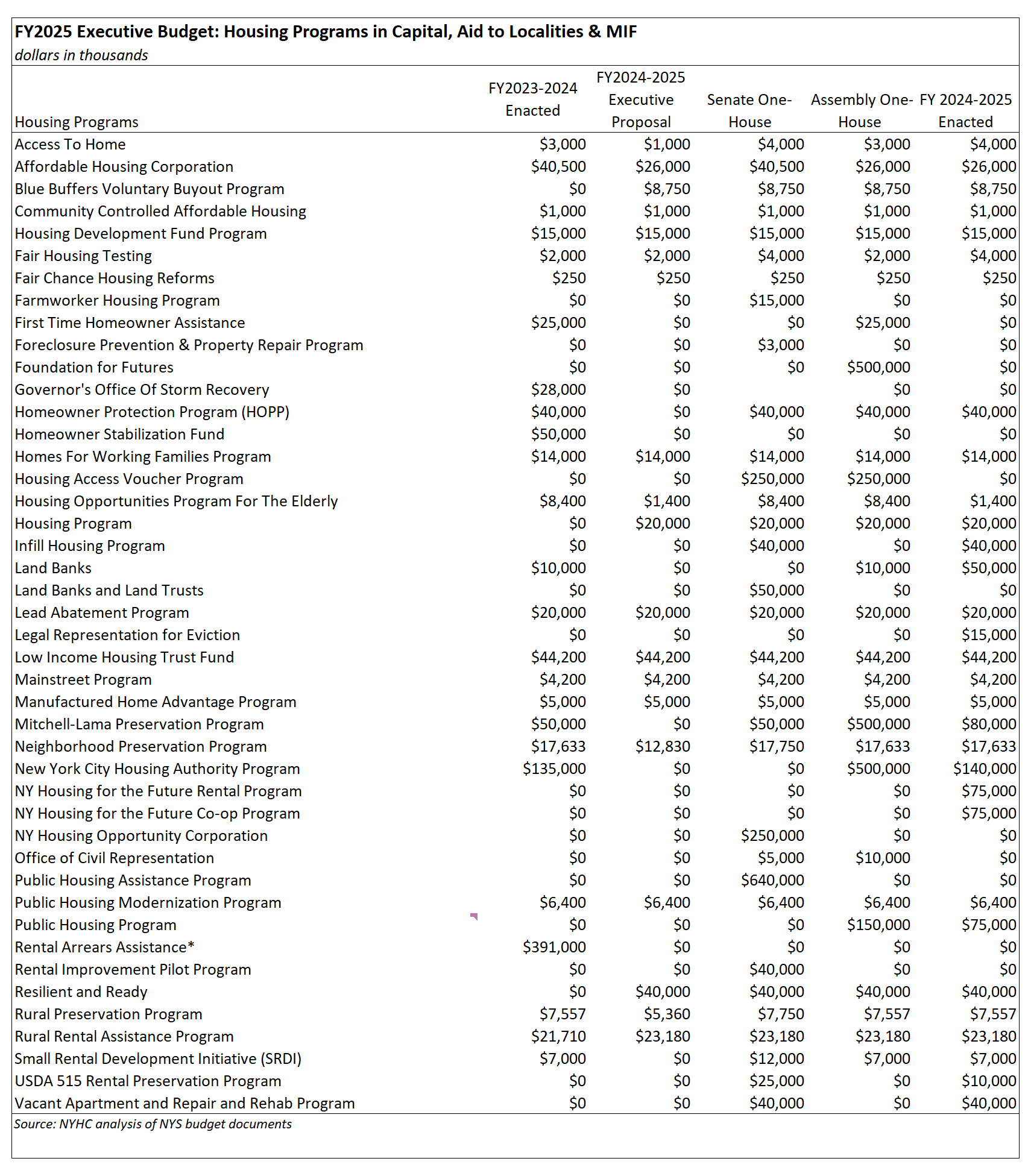

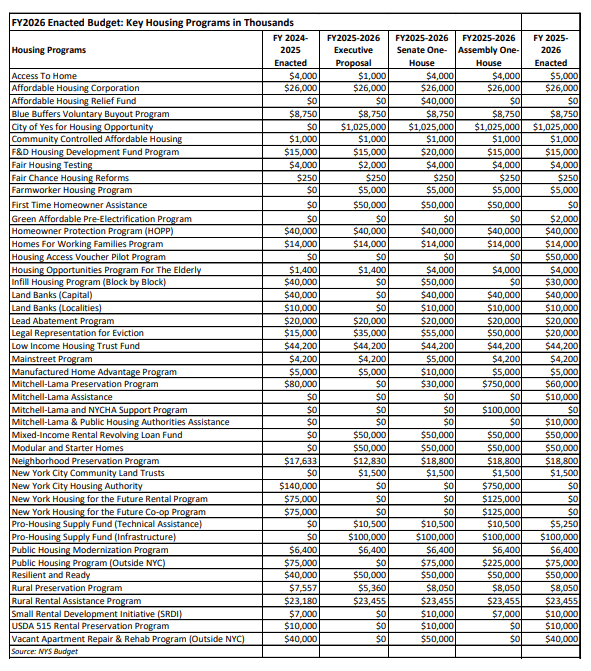

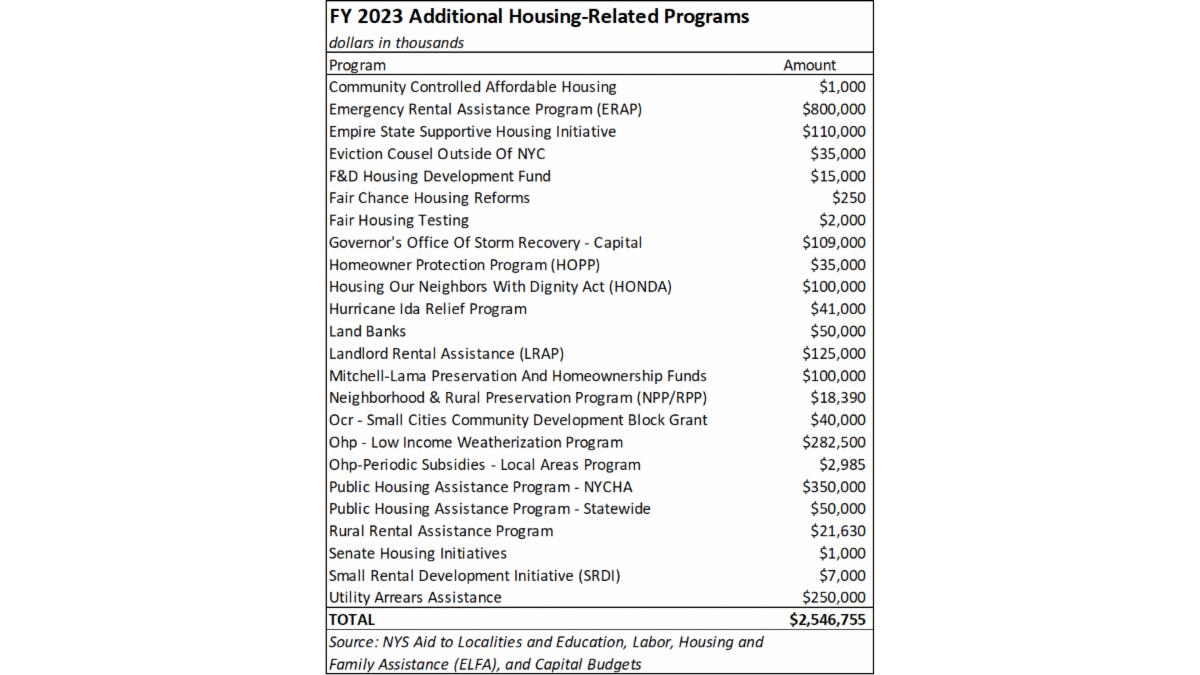

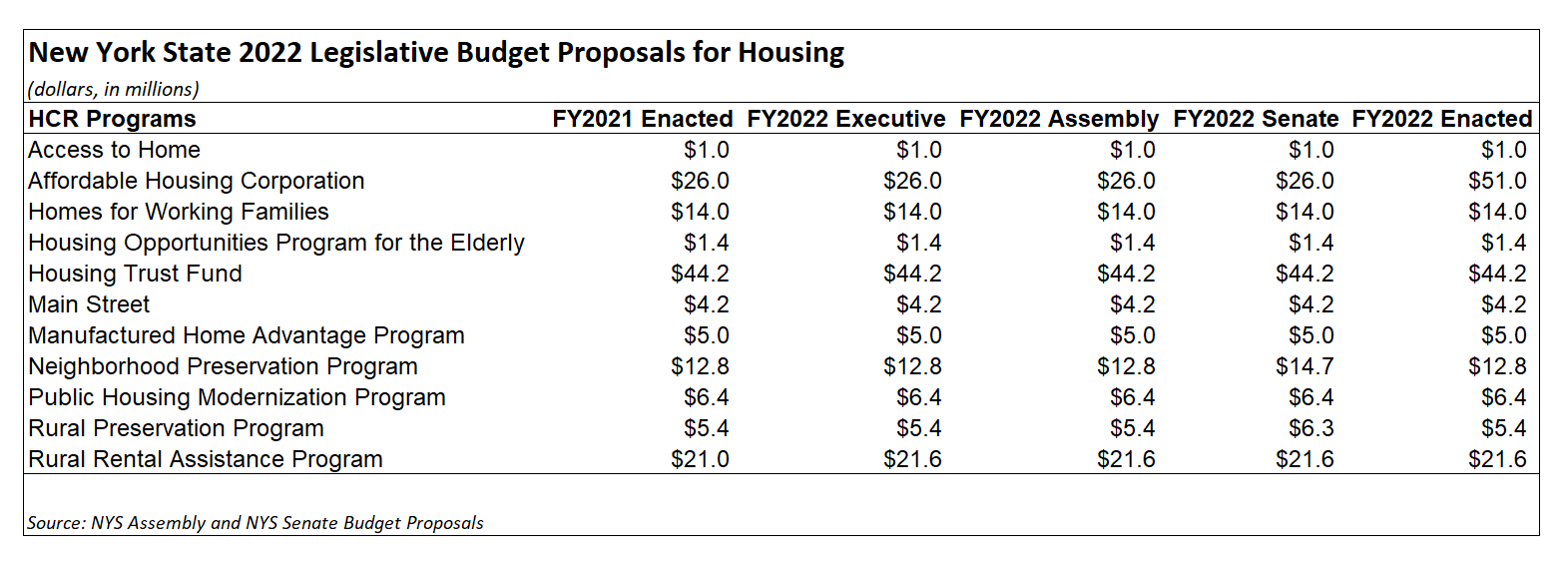

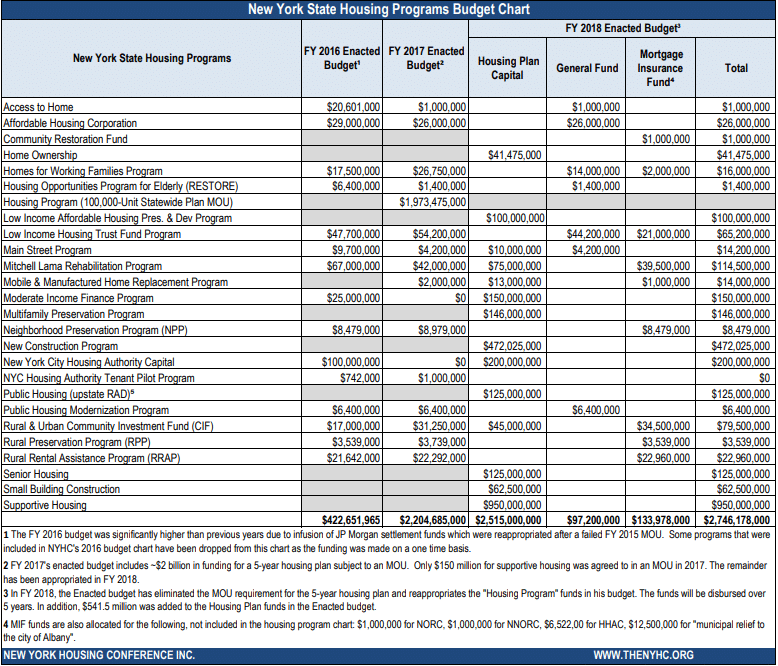

The final budget restores funding to key existing HCR programs, supports the ongoing 5-year housing plan and adds funding for several new initiatives noted above. However, the $427 million capital increase in the “housing program” is not actually additional funding but rather replaces funds used to cover a lapse in the state’s debt authority last year. New and existing housing programs can be viewed in the table below. Note that NYCHA and Housing for the Futures show as $0 because those are included in the broader City of Yes funding:

-

2024-2025

Last week New York’s $237 billion FY 2025 budget was released. It takes significant steps to increase housing supply and addresses other policy issues such as affordable housing insurance discrimination, deed theft and tenant protections and funding was maintained for vital housing programs. However, the budget once again excluded the Housing Access Voucher Program, which would have provided rental assistance to low-income New Yorkers experiencing homelessness and at risk of eviction. NYHC will continue to advocate for this and other desperately needed resources for the most vulnerable renters.

“We applaud Governor Hochul and the NY State Legislature for reaching an agreement on a wide range of policy solutions to address NY’s housing shortage. Tax incentives, zoning changes and new funding will help build more housing and most importantly it will make NY a more affordable place to live in for renters and homeowners. It won’t happen overnight, but this agreement will help increase our housing supply across the state by increasing affordable housing development with tax incentives; allowing Accessory Dwelling Units; facilitating conversions to residential housing; and by fighting insurance discrimination which is making housing more expensive. Albany lawmakers have come together on solutions that will benefit New Yorkers for future generations and we hope they will continue discussing comprehensive solutions to address the housing crisis. While new protections will help limit rent increases for some renters, more resources are needed to help low-income families and people experiencing homeless endure the crushing realities of the tight housing market.” Statement from Rachel Fee, Executive Director of New York Housing Conference on the FY2025 New York State Budget

New York City Housing Policy Changes

Establishes Affordable Neighborhoods for New Yorkers Tax Incentive (ELFA Part U)

The budget replaces the expired 421-a program with Affordable Neighborhoods for New Yorkers (485-x), a new tax incentive for rental and homeownership construction in NYC for projects vested between June 2022 and June 2034 with six or more units of rental or homeownership.Terms of the benefit and wage requirements are determined by the size and location of projects. All projects receive a 100% exemption during construction up to three years. For rental projects with income restricted units, only the affordable units will be subject to rent stabilization, affordability is required in perpetuity and at least half of affordable units must be two bedrooms or larger and no more than 25% can be smaller than one bedroom. For homeownership projects, affordability is required for 20 years.

Minority and Women Owned Business Enterprises (MWBE) Requirement

The bill requires that eligible sites make all reasonable efforts to spend 25% of total design and

construction costs on MWBEs.Enforcement

The bill creates new notification requirements and enforcement terms. It includes language to

allow HPD to determine appropriate fines for violations of affordability and rent stabilization terms.

It requires owners to register with HPD within 6 months or pay a penalty equal to the application

fee. They must also notify both HPD and the NYC Comptroller of the anticipated start and end

date of construction and the existence of a labor agreement within 3 months prior to construction.

Failure to provide such notice will result in fines up to $5,000 and forfeiture of the benefit. Further,

the Comptroller will have the authority revoke benefits for violating wage agreements for

construction or building service employees.NYHC strongly supports an as of right tax abatement to encourage mixed income rental housing that

better reflects the needs of low-income New Yorkers. While we were advocating for lower income levels

given the huge increase in AMI in recent years, we are pleased the Governor and the Legislature were

able to come to an agreement on a program that eliminates the highest incomes, maintains affordability

in perpetuity and better addresses cross subsidy challenges.Extends 421-a Project Completion Deadline for Vested Projects (ELFA Part T)

The deadline to complete 421-a projects already in the pipeline is extended from June 15, 2026

to June 15, 2031 and excludes the highest income affordability options, which produced 30% of

units at 130% AMI. The bill requires HPD to develop an application form within 60 days and for

developers to submit such form within 90 days of it becoming available.NYHC supports extending the deadline to allow projects already in the pipeline to be completed

and the exclusion of the highest income units.Requires Annual Audits of 421-a Projects (ELFA Part JJ)

HPD must develop a program to conduct annual random audits of 421-a projects receiving

benefits since 2014 for compliance with rent registration, affordability, and rent stabilization

requirements under the affordable New York housing program. The first audit will be due by

December 31, 2025 and the results will be made public. No more than 25% of eligible properties

can be subject to an audit each year and no project can be audited in two consecutive years.Affordable Housing from Commercial Conversion (AHCC) Tax Incentive (ELFA Part R)

Establishes the AHCC program in NYC to provide a tax exemption for commercial to residential

conversions that produce at least six rental units. It would require at least 25% of units be

affordable in perpetuity, averaging at or below 80% AMI. At least 5% must be affordable at or

below 40% AMI with none exceeding 100% AMI. The program applies to projects vested from

January 2023 to June 2031 and completed by 2039.The tax exemption would be subject to prevailing wages for building service workers during the

benefit period except in buildings with fewer than 30 units or that receive substantial government

assistance or subsidy to develop affordable housing. The exemption also establishes terms for

revoking the benefit for violating wage or affordability requirements.The terms of the benefit are determined by when buildings are vested and whether they are in the Manhattan prime development area (south of 96th street):

By June 30, 2026: 35-year benefit

100% exemption during construction

First 30 years: 90% exemption in Manhattan prime and 65% outside

Year 31: 80% exemption in Manhattan prime and 50% outside

Years 32-35: 10% annual decrease in exemption in all areasBy June 30, 2028: 30-year benefit

100% exemption during construction

First 25 years: 90% exemption in Manhattan prime and 65% outside

Year 26: 80% exemption in Manhattan prime and 50% outside

Years 27-30: 10% annual decrease in exemption in all areasBy June 30, 2031 – 25-year benefit

100% exemption during construction

First 20 years: 90% exemption in Manhattan prime and 65% outside

Year 21: 80% exemption in Manhattan prime and 50% outside

Years 22-25: 10% annual decrease in exemption in all areasNYHC strongly supports commercial conversion tax incentive benefits requiring affordable

housing and we are happy to see the affordability requirement increase from 20% proposed in

the Executive Budget to 25% as proposed in the Senate one-house.Reforming Floor Area Ratio Cap (ELFA Part Q)

The budget allows NYC to exceed the 12-FAR cap of certain buildings, in accordance with local

zoning laws, ordinances or resolutions. It clarifies that FAR can only be exceeded for projects that

have gone through the public review process and are subject to Mandatory Inclusionary Housing

(MIH) or equivalent affordability requirements.The bill excludes historic districts and lots with joint live work quarters for artists or lofts. It also

includes language requiring the offer of compensation and relocation assistance for existing

tenants in buildings that are demolished to rebuild beyond 12 FAR.NYHC has been championing this policy change for nearly a decade.

Basement Apartment Legalization Pilot in NYC (ELFA Part S)

A pilot program is created to convert occupied some illegal basement apartments in NYC to legal

dwelling units that meet health and safety standards. It requires standard to be established in

consultation with the NYC fire department, the NYC department of buildings, and the NYC office

of emergency management. Units located in flood hazard areas will need to meet additional

standard.The program exempts any necessary zoning changes from environmental review but does

require a public hearing and approval by the City Planning Commission and approval by the City

Council. It provides amnesty to property owners who convert these units and a right of first refusal

to return for tenants who need to be removed while their units are brought into compliance. It also

includes language for court action and compensation for tenants who are denied their right of first

refusal.The Community Districts covered include:

Bronx CDs 9, 10, 11, 12

Brooklyn CDs 4, 10, 11, 17

Manhattan CDs 2, 3, 9, 10, 11, 12

Queens CD 2NYHC strongly supports the creation of a basement apartment legalization program to improve housing

quality and safety for current residents of illegal basement and cellar apartments. However, we regret that

many Queens & Brooklyn neighborhoods that would benefit most were excluded from the pilot.Increases the Amount Recoverable by an Owner for Certain Individual Apartment

Improvements (IAI) (ELFA Part FF)

The budget increases the amount that can be recouped for improvements to individual rent

stabilized apartments from $15,000 to $30,000 and to $50,000 for vacant apartments that were

continuously occupied for at least 25 years prior to vacancy. It also makes these increases

permanent.NYHC recognizes that changes to IAIs were inadequate to recoup the cost of improvements

through rent increases. We strongly opposed proposed language to reset the rents of long tenancy vacant apartments which could have led to rent increases of over 100%. We believe this

IAI reform is a reasonable compromise balancing owners need to recoup investment with

affordability.Enacts Good Cause Eviction (ELFA Part HH)

The budget includes good cause eviction protections for certain unregulated renters in NYC and

allows localities outside of the city to opt-in, with the flexibility to make some changes in local law.

The bill requires a “good cause” to evict or refuse to renew a lease. Reasons considered good cause include:-

- Non-payment of rent, unless it was due to an “unreasonable” rent increase. (Rent increases of 5% plus the annual change in the consumer price index or 10% whichever is lower, are presumed unreasonable.)

-

- Lease violations

-

- Nuisance or damage

-

- Breaking the law and the remedy involves vacating the unit

-

- Illegal use of a unit

-

- Unreasonable refusal of access to unit

-

- Refusal to agree to reasonable changes at lease renewal

-

- Good faith recovery for the landlord or family member to occupy as their primary

residence, unless the tenant is 65 years or older or disabled.

- Good faith recovery for the landlord or family member to occupy as their primary

-

- Good faith effort to demolish the building

-

- Good faith withdrawal of the unit from the rental market

The bill exempts:

-

- Affordable housing because renters in regulated and public housing already have a right to lease renewal and rent increases are limited by other state and federal laws.

-

- Owner-occupied buildings with 10 units or less.

-

- Owners with portfolios of 10 units or less, however must provide proof if they claim this exemption in court.

-

- Cooperatives and condominiums

-

- Units with rent that exceed 245% FMR, or currently $6,742 for a two-bedroom

-

- New construction for 30 years, beginning with buildings built on January 1, 2009.

-

- Other forms of housing such as retirement communities, hospitals and adult care facilities, manufactured homes, hotel rooms, dormitories and religious housing

Landlords of units subject to good cause will have to give tenants notice a rent increase above

the rent reasonableness threshold and provide justification for the increase. They will also have to

give notice and the reason for nonrenewal. Landlords who are exempt from good cause

provisions will have to give the reason for the exemption.While NYHC did not take a position on the original good cause bill, our analysis suggests that the

exemptions in this budget will result in protections for a relatively narrow universe of unregulated

tenants. For example, while we cannot cross reference with portfolio size or owner occupancy,

we know that about 140,000 condo and co-op units are exempt and 75% of non co-op/condo

unregulated rental units are in buildings with fewer than 10 units.Public Housing

The budget includes $140 million for the New York City Housing Authority, significantly less than

the $500 million proposed in both the Senate and Assembly one-houses and $75 million for

public housing outside of NYC.NYHC strongly supports state funding for NYCHA capital improvements.

Statewide Housing Policy Changes

Housing on State Land (Capital S8304-D)

The budget includes $250 million as part of a larger $500 million commitment to develop up to 15,000

units of housing on state-owned sites across New York as part of the Governor’s Redevelopment of

Underutilized Sites for Housing (RUSH) initiative. Sites will become available on an individual basis as the

state issues requests for proposals to develop them.Strengthen Pro-Housing Communities Designation (Capital)

The budget enables the State to make the Pro-Housing Communities certification a requirement

to receive up to $650 million in state discretionary funding programs for housing, economic

development and transportation.NYHC supports strong incentives to build housing, but we continue to call for a statewide

framework to increase housing supply and eliminate exclusionary zoning.Address Discrimination in Affordable Housing Insurance (ELFA Part BB)

The budget includes language that property and liability insurers cannot “cancel, refuse to issue,

refuse to renew or increase the premium of a policy, or exclude, limit, restrict, or reduce coverage

under a policy” based on the existence of income restricted units, the source of income of the

tenants or shareholders, the receipt of government subsidy, or the owner being a public housing

agency or a limited equity co-op. It also prohibits them from asking about these factors in an

application.NYHC strongly supports this language to ban discrimination against affordable housing in

both property and liability insurance. Recent NYHC analysis found blatant discrimination in

correspondence between our partners and brokers/insurance companies.Opt-In Multifamily Tax Incentive (ELFA Part EE)

The budget creates an optional multifamily rental tax exemption for localities outside of NYC for

new construction and conversions on vacant and underutilized land with at least 10 units of rental

housing and income restricted units that serve an average of 60% – 80% AMI, with a max of

100% AMI. Income restrictions last for the benefit period, however rent restricted tenants have a

right to lease renewals for their entire tenancy. In mixed use buildings, at least 50% of the square

footage must be rental housing.Buildings that are 25% affordable will receive a 100% exemption during construction for up to 3

years followed by an exemption for 25 years that starts at 96% and decreases by 4% each year.

Prevailing wage applies for building service employees except in buildings with less than 30 units

or that have substantial government subsidy.Buildings that are 100% affordable will receive a 100% exemption during construction up to 3

years followed by a 30-year exemption. Up to 2 units may not be income restricted to be occupied

by property employees such as superintendents as part of their compensation.NYHC supports standardizing tax incentives for rental housing with affordable housing

requirements across the state.Opt-In Accessory Dwelling Unit (ADU) Tax Exemption (ELFA Part GG)

The budget includes language to define ADUs as a housing accommodation in the human rights

law and creates the terms of an optional ADU tax exemption on the increase in value of property

that results from the addition of an ADU.Localities may adopt the exemption after a public hearing exemption. It is limited to ADUs added

to single and two-family homes and cannot exceed $200,000 in increased market value. For the

first five years, it will provide a 100% exemption on the increase in assessed value. Over the

following five years, it will phase out based on a percentage of the increase in assessed value.NYHC strongly supports ADU legalization and tax incentives that support homeowners who want

to create them. We will continue to explore the additional policy implications if any, of adding

ADUs to the definition of housing accommodation statewide.Safety Standard for Single Exit, Single Stairway Buildings (ELFA Part V)

The budget includes language to require the State Fire Prevention and Building Code Council

conduct a study relating to standards for egress including existing building codes for single-exit,

single stairway multifamily buildings that are above three stories and up to at least six stories. The

bill requires the study be completed by July 1, 2026 and allows the council to amend the uniform

code based on its findings.NYHC strongly supports allowing single-stair construction to reduce the cost of

building housing and to make more efficient use of sites. This is a “no cost” way for the

Legislature to help bring down housing costs.Heirs Property Protection and Deed Theft Prevention Act of 2024 (ELFA Part O)

The budget includes language that establishes deed theft as a specific form of larceny, creates a

clear definition of the crime of deed theft and authorizes the Attorney General to prosecute such

crimes. It further prohibits outside parties that did not inherit shares of a property from initiating

partition actions and establishes a right of first refusal for heirs when an outside party makes an

offer to purchase one owner’s shares. These changes limit the ability of predatory investors to

acquire interests in inherited property and pressure homeowners into selling their family homes.

The bill also establishes a Transfer on Death Deed, which would allow homeowners to determine

the beneficiary of their property, without the necessity of drafting a formal will.New York Housing for the Future Homeownership Program and the New York Housing for

the Future Rental Housing Program (ELFA Part KK)

Two new housing programs are established and provided $150 million to provide assistance in

the form of payments, grants and loans to support affordable rental housing and limited equity

cooperative homeownership opportunities serving households up to 130% AMI and projects

would be subject to prevailing wage. Much of the details of the programs are to be determined by

HCR.USDA 515 Rental Property Preservation (Capital)

The budget includes $10 million to preserve USDA 515 rental properties whose mortgages and

affordability protections are set to expire. These projects are affordable rentals built with USDA

funding in the 1990’s and early 2000’s in rural areas of the state. There are about 400 of these

properties encompassing 22,000 affordable rental apartments in New York. This is less than the

$25 million proposed in the Senate one-house.NYHC strongly supports this funding which is a top priority for our partners at the Rural Housing

Coalition of NY.Infill Housing Pilot Program (Capital)

The budget includes a Senate proposal for $40 million for an infill housing program to construct

one to two family homes for purchase affordable to low-moderate income buyers in Buffalo,

Binghamton, Albany, Syracuse, and Rochester. The program would prioritize vacant, abandoned,

or under-utilized land owned by the municipality.Vacant Apartment Repair and Rehabilitation Program (Capital)

The budget includes $40 million to provide grants of up to $75,000/unit to repair vacant

apartments outside of NYC, a modified Senate proposal.Clarifies When a Landlord-tenant Relationship Exists (ELFA Part II)

The budget clarifies that squatters are not tenants and defines squatters as those that intrude

upon real property without the permission of the person entitled to possession and continue to

occupy the property without title, right or permission of the owner or owner’s agent or a person

entitled to possession.Other Budget Highlights

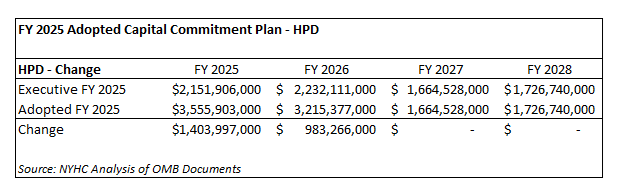

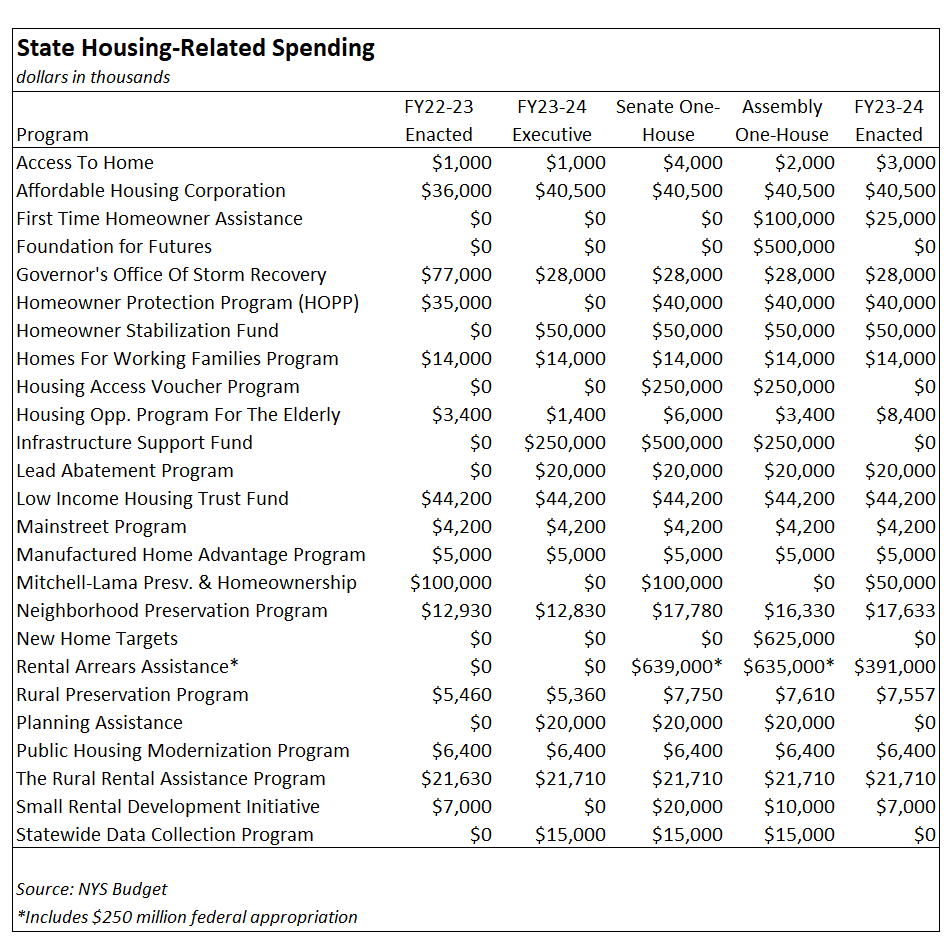

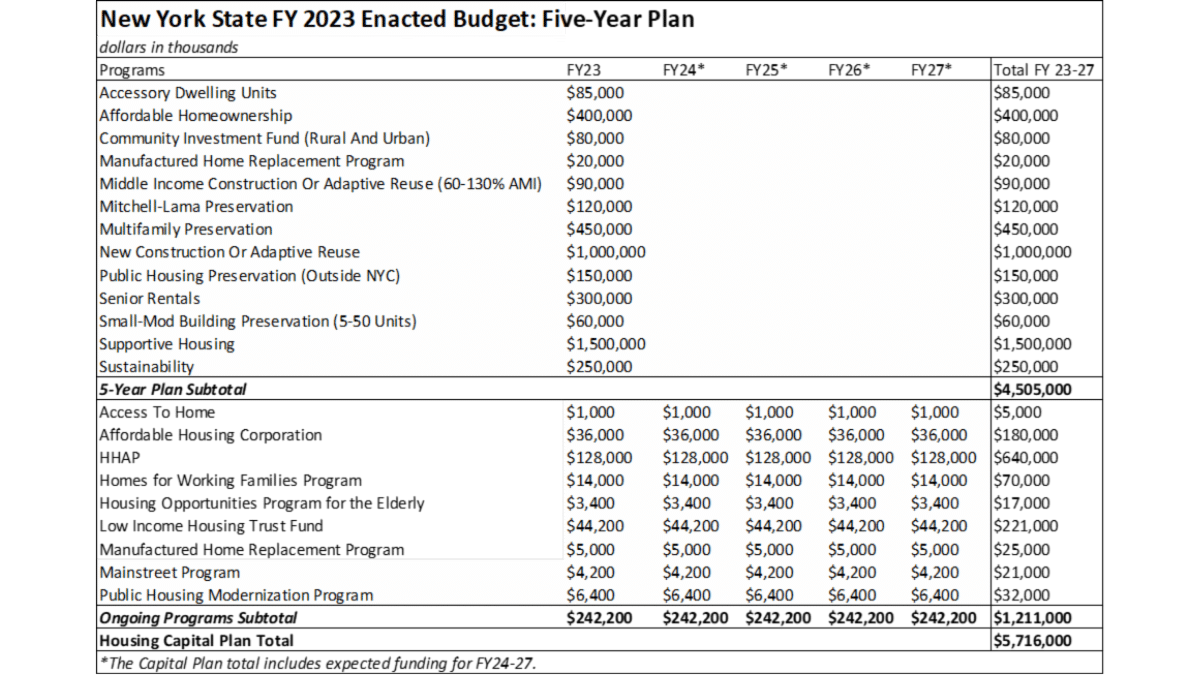

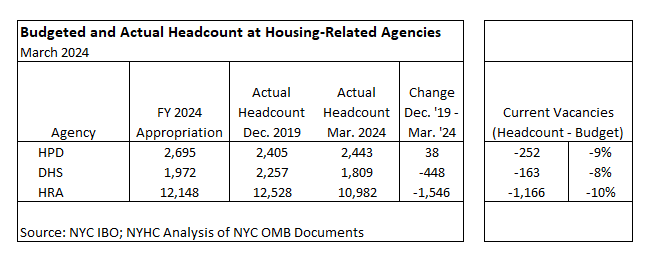

As seen in the table below, funding was restored for programs that were cut in the executive

budget, such as the Rural and Neighborhood Preservation Programs, the Small Rental