- LIHTC Income Averaging

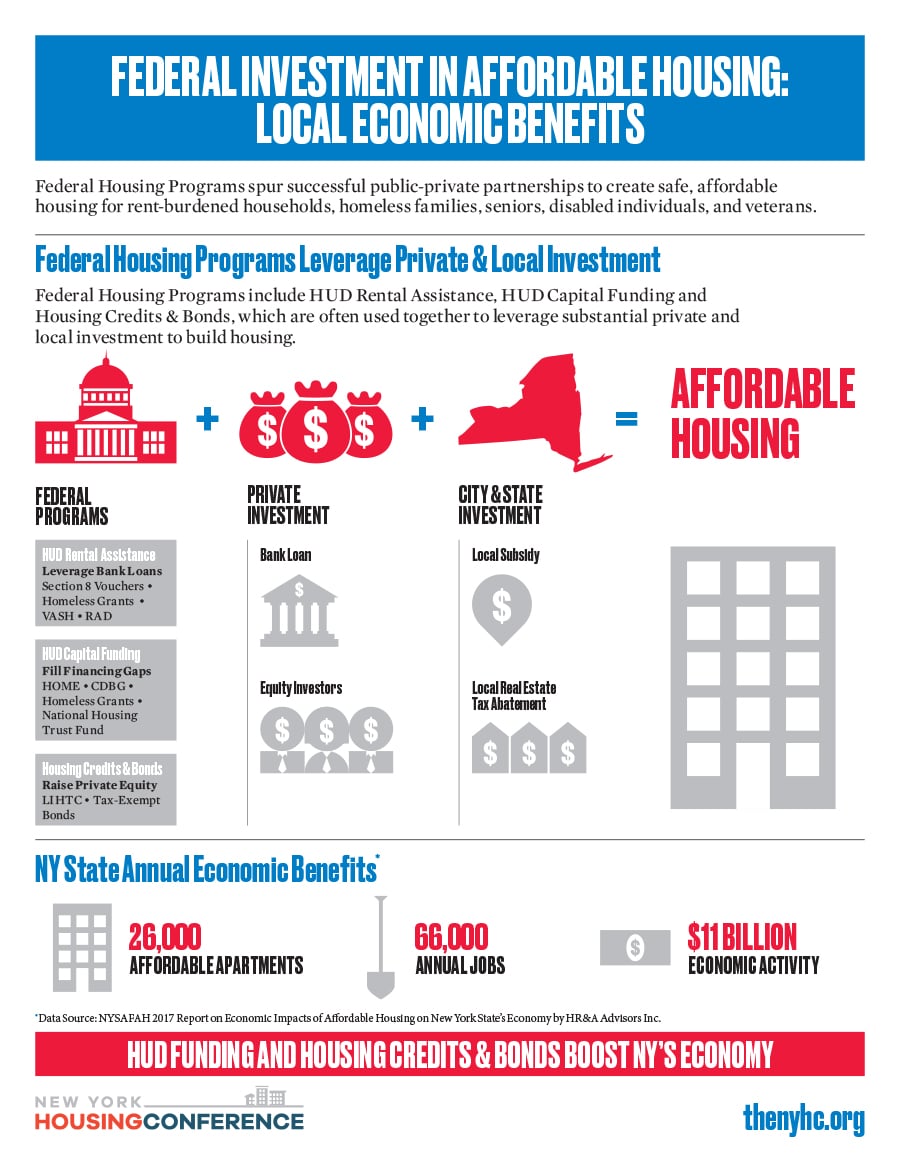

- Federal Investment in Affordable Housing

- Tax-Exempt Bonds

- Rental Assistance Demonstration (RAD)

![]()

LEGISLATIVE SUCCESS: INCOME AVERAGING ENACTED INTO LAW IN FY 2018 OMNIBUS BILL!

Stay tuned for information about how Income Averaging will be used in NY.

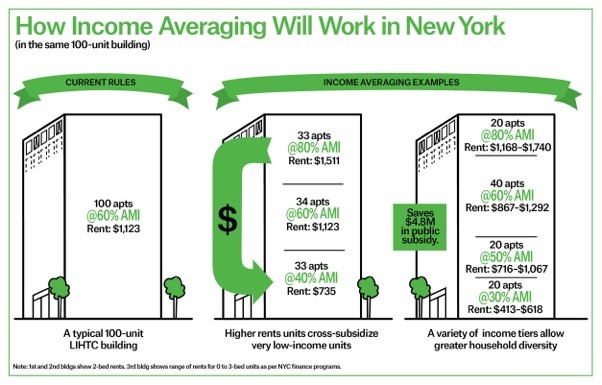

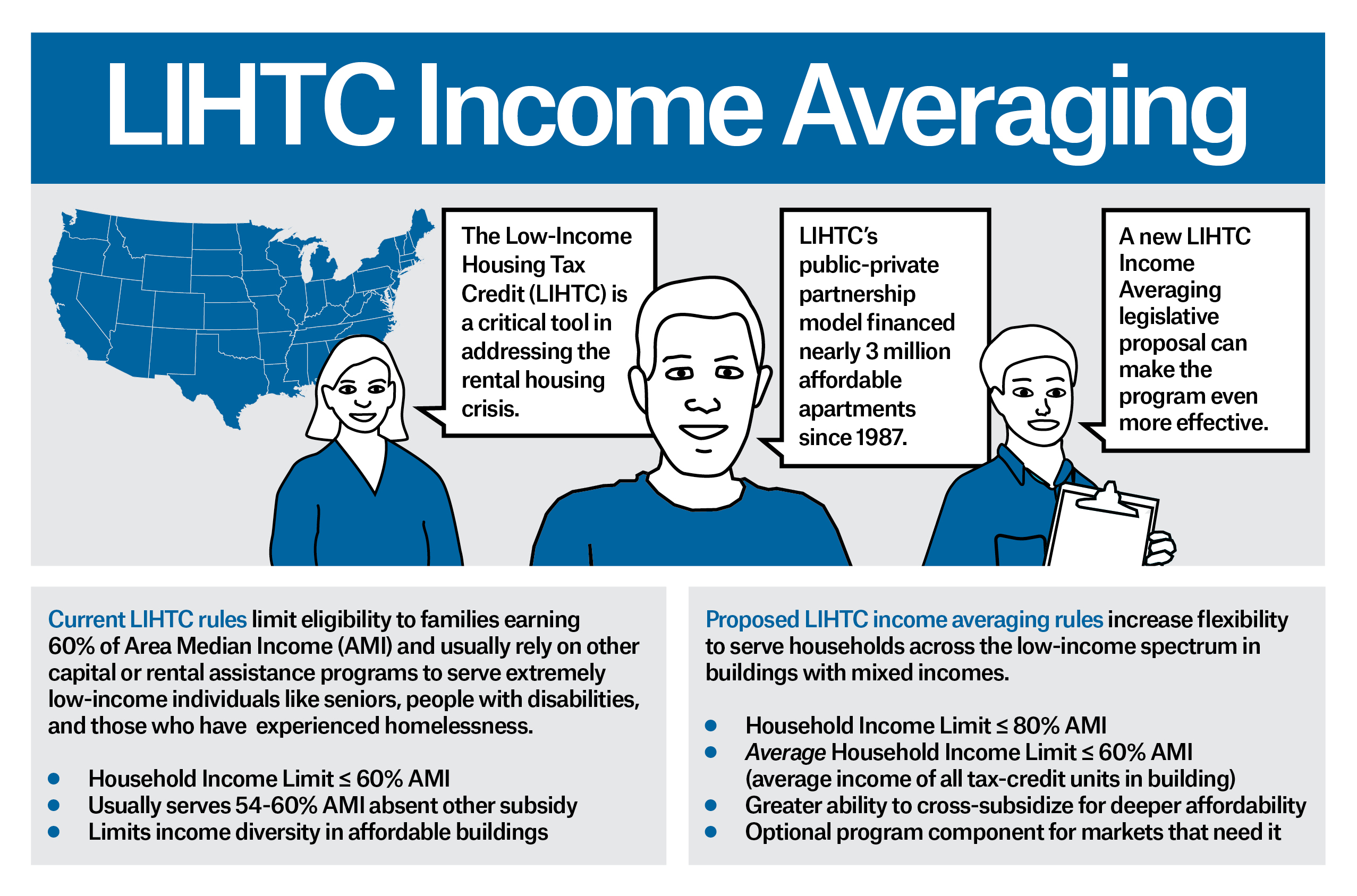

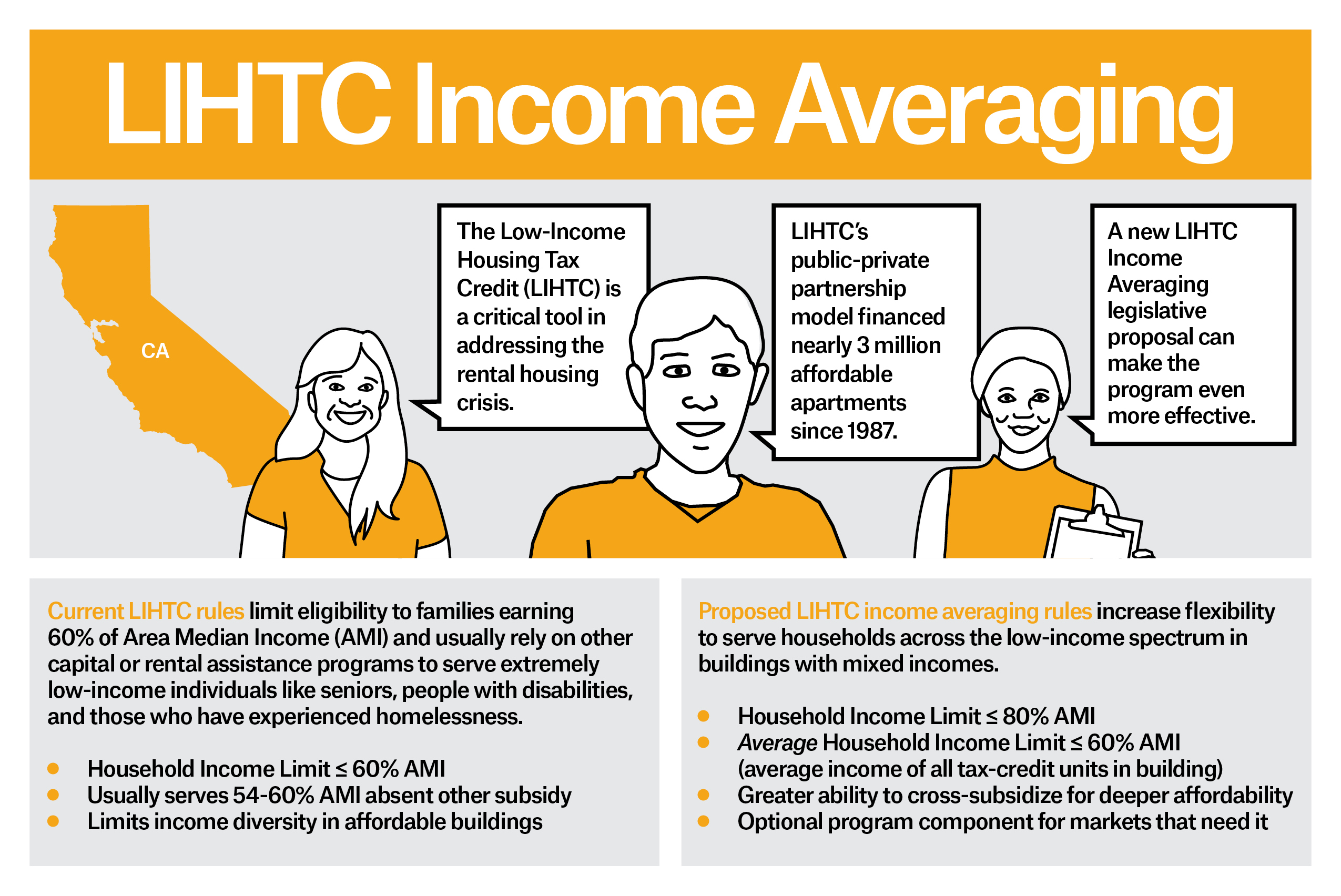

NYHC & NHC developed LIHTC Income Averaging, an infographic to explain the federal legislative proposal (now law) for income diversity in the housing tax credit and the potential benefits to affordable housing production in New York State and other high-cost markets. The advocacy and educational campaign was an enormous success and the proposal was signed into law in March 2018. LIHTC Income Averaging will make it easier to build housing affordable to extremely low-income households by raising the LIHTC income limit from 60% of Area Median Income to 80% AMI and allowing cross subsidization of rents within buildings.

Click the image below to download the New York-version of two page handout

Click the image below to download the National-version of two page handout

Click the image below to download the California-version of two page handout

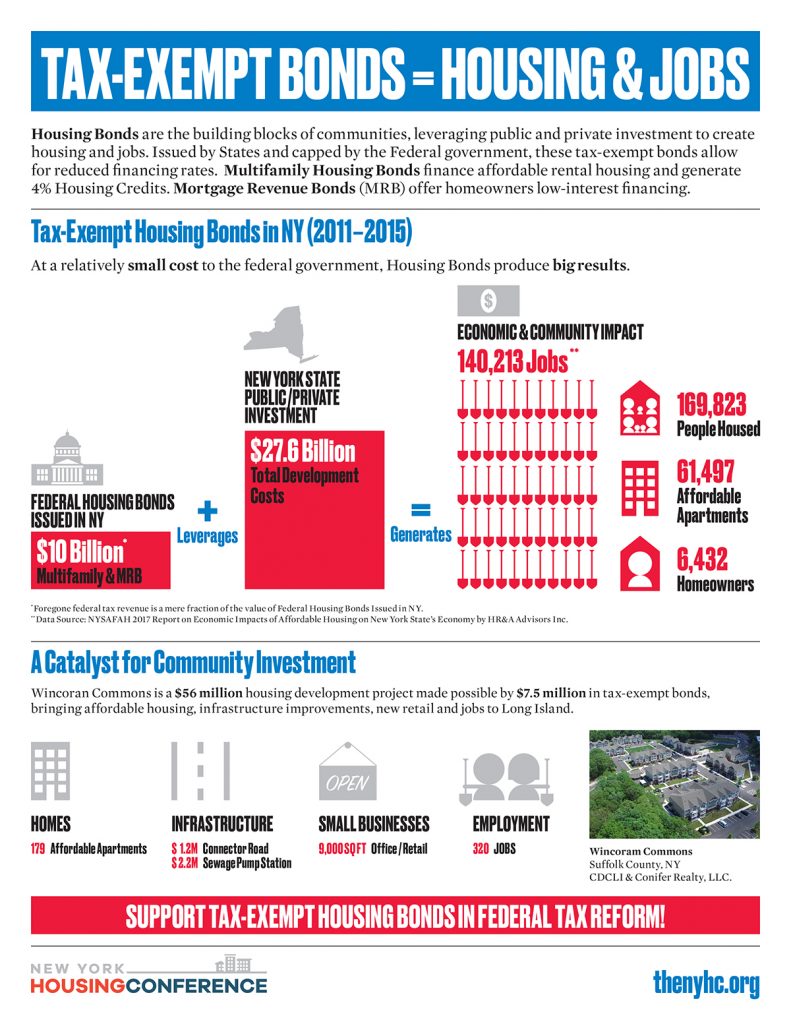

Tax-Exempt Housing Bonds are a vital financing tool that leverages public and private investment into affordable housing and economic growth. At marginal expense to the federal government, housing bonds put into a motion a huge multiplier effect that produces jobs and bolsters our country’s rental and owner-occupied housing stock.

Click the image below to download our infographic about income averaging.

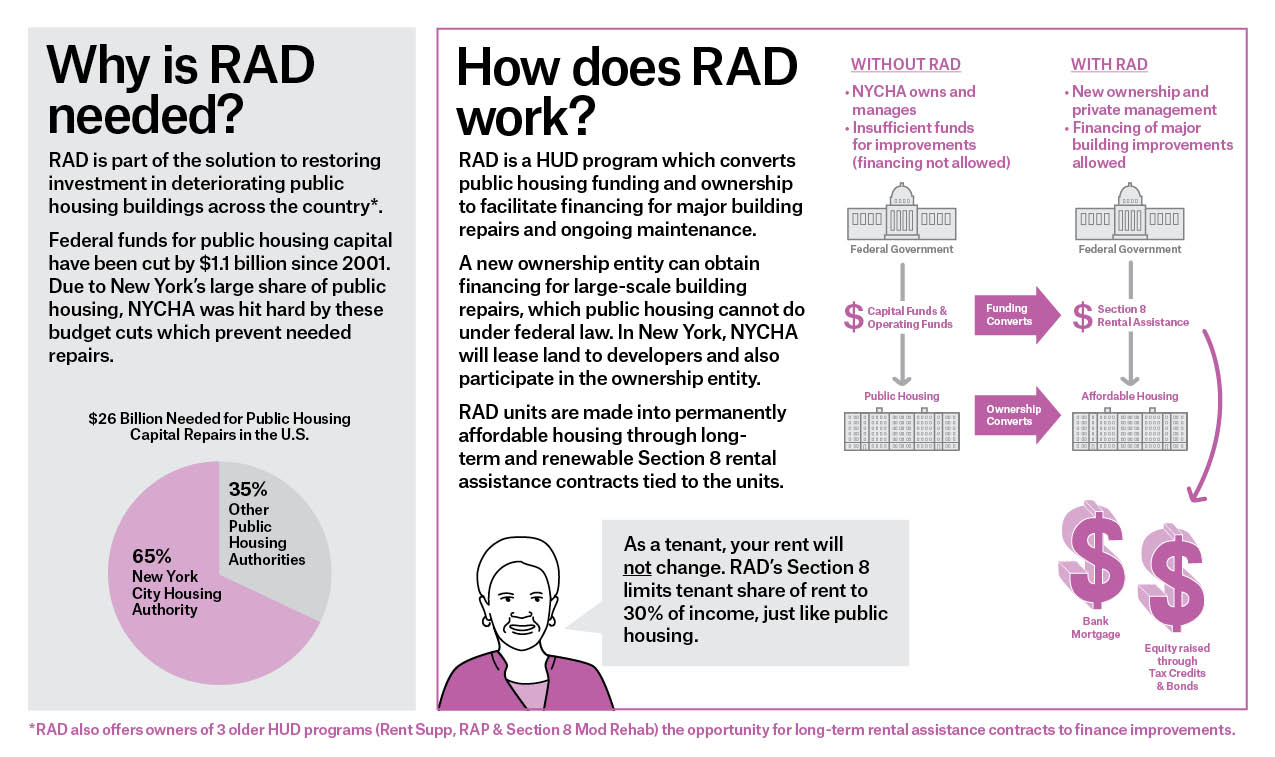

NYHC developed the Rental Assistance Demonstration (RAD) infographic to highlight the benefits of RAD and address important public housing resident questions on tenant rights. Click to download full document.