Last week the Legislature released their one-house budgets outlining their priorities and formally kicking off budget negotiations. The housing growth strategy outlined in both the Senate and Assembly versions of the budget bill is a weak, incentive-driven approach that we know hasn’t worked in other states. The crisis is too dire to try and resuscitate failed housing policies of decades past. Localities may opt in or not. Even data collection is optional. It’s all carrots and no sticks- it is not a serious plan.

We hope the Legislature will enter into meaningful negotiations with Governor Hochul to adopt a version of the Housing Compact that will help address NY’s housing supply shortage. Based on our many meetings, there are clear opportunities for compromise around density levels, counting of growth targets and longer look back and compliance periods. But without some version of a builder’s remedy, NY will not see cooperation from localities that oppose housing growth and the same existing patterns of residential racial segregation will persist.

Housing Compact

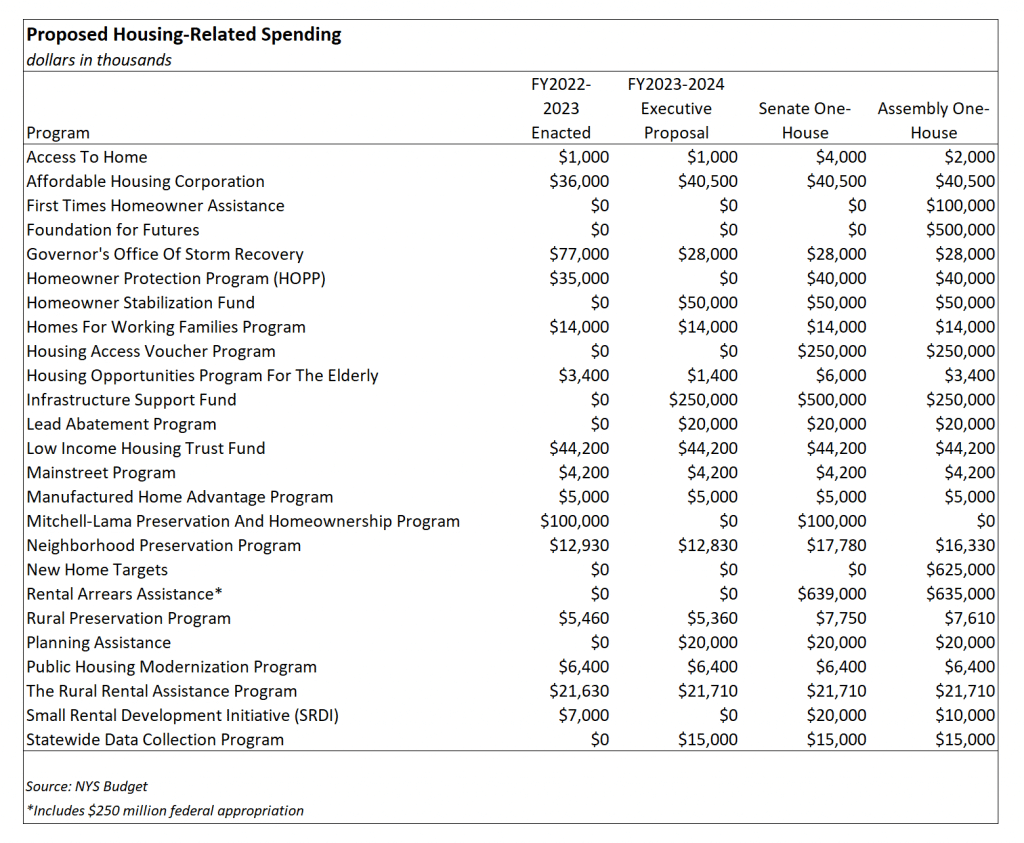

Both the Senate and Assembly one-house budgets drastically weaken the Housing Compact land use proposals and incentives included in the Governor’s Executive budget. All requirements for growth in every community and increased density were excluded from both budgets as well as the supporting tax incentives and fixes for New York City specific issues. The Houses differ slightly in their structure of the program:

Growth Targets:

Both Houses replaced the growth requirements with incentive only targets using the same metrics – 3 percent downstate and 1 percent upstate over 3 years. Localities that meet these targets would be able to access new funding to incentivize housing production.

The Senate provides $500 million for the housing infrastructure fund and the Assembly provides $250 million for the housing infrastructure fund plus $500 million to incentivize localities outside of NYC to meet growth targets and $125 million for NYC to meet its growth targets.

The Senate version maintains that affordable housing units counts double towards the target and previously abandoned property counts 1.5 times.

The Assembly version also counts units on previously abandoned property at 1.5 times. However it, counts affordable units at 80 percent AMI and below and supportive units double and affordable units at 50 percent AMI and below triple towards the target. The Assembly also double counts units that meet a number of other qualifications including accessory dwelling units (ADUs), and units located within a half mile radius of downstate rail stations, on lot-splits, or on previously commercial land.

The Assembly would set targets for all of NYC as opposed to setting targets at the community district level. NYHC has some concerns with this approach. As we found in our NYC Council affordable housing tracking report, affordable housing development throughout NYC was highly concentrated in low-income neighborhoods of color. Without a mandate for growth that requires all communities to do their fair share, we will continue to see these inequitable development trends.

Reporting:

Reporting on housing construction, conversion, alteration, demolition and zoning data is optional in both Houses. In the Assembly, municipalities that apply for funding are required to submit data on existing housing stock and a completion report with data on new units permitted during the growth cycle.

Accessing Funding:

The Senate would create a land use advisory council to review municipal growth over the next three years, and award funding from the $500 million housing infrastructure fund to municipalities that achieve target goals or adopt a preferred action. The council would have 5 members – 3 appointed by the Governor, and 1 each by the Speaker of the Assembly and Leader in the Senate.

Under the Senate proposal, municipalities could either meet the growth target or take one of 6 preferred actions to access funding. This is a major deviation from the Governor’s proposal where 2 preferred actions were needed to avoid a builder’s remedy. The preferred actions are the same as proposed in the Governor’s budget – legalizing accessory dwelling units, facilitating lot splits, eliminating exclusionary zoning, smart growth rezonings and adaptive reuse rezonings on commercial land. It also adds transit-oriented development (TOD) as a preferred action. All preferred actions would be allowed to bypass the State Environmental Review Process (SEQR) if they meet certain criteria.

The Assembly requires that interested municipalities submit a housing action plan to HCR outlining how they will meet or exceed the target in order to receive funding. After submitting their plans, municipalities would receive their first round of funding under the following payment schedule:

Cities with populations:

- Under 10,000 – $600,000

- 10,000 – 35,000 – $1.2 million

- 35,000 – 95,000 – $3.75 million

- Above 95,000 – $7.5 million

Towns with populations:

- Under 10,000 – $15,000

- 10,000 – 35,000 – $45,000

- 35,000 – 95,000 – $90,000

- Above 95,000 – $250,000

Villages with populations:

- Under 10,000 – $15,000

- 10,000 – 35,000 – $45,000

- Over 35,000 – $90,000

Municipalities that meet the growth target will receive second payments after every unit has been issued a certificate of occupancy plus a 24- month grace period. Municipalities that don’t meet their target will have the initial payment minus an amount proportional to the units they did build removed from other forms of state aid.

For those meeting the target but less than 20 percent of units are affordable:

Cities with populations:

- Under 10,000 – $800,000

- 10,000 – 35,000 – $1.6 million

- 35,000 – 95,000 – $5 million

- Above 95,000 – $10 million

Towns with populations:

- Under 10,000 – $20,000

- 10,000 – 35,000 – $60,000

- 35,000 – 95,000 – $120,000

- Above 95,000 – $300,000

Villages with populations:

- Under 10,000 – $20,000

- 10,000 – 35,000 – $60,000

- Over 35,000 – $120,000

If at least 20 percent of the growth is affordable:

Cities with populations:

- Under 10,000 – $1.4 million

- 10,000 – 35,000 – $2.8 million

- 35,000 – 95,000 – $8.75 million

- Above 95,000 – $17.5 million

Towns with populations:

- Under 10,000 – $35,000

- 10,000 – 35,000 – $105,000

- 35,000 – 95,000 – $210,000

- Above 95,000 – $525,000

Villages with populations:

- Under 10,000 – $35,000

- 10,000 – 35,000 – $105,000

- Over 35,000 – $210,000

New York City would receive an initial payment of $37.5 million. If less than 20 percent of units are affordable, the second payment would be $50 million and $87.5 million if more than 20 percent.

To give an example of the options a locality will face under the Assembly’s plan, the Village of Scarsdale can submit a housing plan to HCR and they will receive $45k, then if they meet their 3% growth target, they will receive $60-105K in 3-5 years. Or, they may just opt out and build no housing and submit no data. This amount of funding is insignificant to wealthy localities that are invested in opposing new housing.

Transit Oriented Development:

Both Houses remove the requirement for downstate localities to rezone for a minimum average density within a half mile of rail stations including NYC subways within 3 years.

The Assembly counts downstate units within this radius as double towards meeting growth targets.

The Senate includes TOD in a list of preferred actions municipalities can take to access funding. It establishes 6 transit zones based on proximity to NYC as opposed to the 4 proposed in the Governor’s Housing Compact. The final tier expands TOD to the rest of the state to include certain bus and rail stations such as Amtrak.

- Tier 1: NYC – 50 units/acre

- Tier 2: within 15 miles of NYC – 40 units/acre

- Tier 3: 15-30 miles – 30 units/acre

- Tier 4: 30-50 miles – 20 units/acre

- Tier 5: 50+ miles – 15 units/acre

- Tier 6: 50+ – 15 units/acre

The Senate provides a streamlined review process for TOD projects by allowing them to bypass SEQR if they meet certain requirements.

Commercial Conversions:

The Senate combines NYC commercial conversion regulatory changes with the Affordable Housing from Commercial Conversions (AHCC) tax incentive proposed in the Executive budget and creates an opt-in tax incentive for the rest of the state.

The opt-in tax incentive for the rest of the state would be available to buildings with twenty or more rental units, where at least 20 percent are available to housings at 80 percent AMI and below at initial rental and no more than 100 percent AMI for subsequent rentals. The program provides a full exemption during construction for a maximum of 3 years and then receive a 50 percent exemption for 30 years. However, taxes shall be paid during the exemption period in an amount at least equal to the taxes paid on such land and any improvements thereon during the tax year preceding the commencement of such exemption and they cannot receive another tax exemption at the same time.

The Assembly excludes language that expanded opportunities for commercial conversions in NYC and all tax incentives.

Special Joint Legislative Commission on Affordable Housing

Both Houses propose advancing legislation to create a special joint legislative commission on affordable housing (S9462/A10494-A). This bill was passed by the legislature last year but vetoed by the Governor. The commission would make recommendations to the legislature on how to preserve and maintain existing affordable housing, to support the development of new affordable housing in the state of New York, to strengthen and grow diverse and stable communities, and to maximize the impact of private, state, local and federal resources by ensuring long term affordability.

Rental Assistance

Both the Senate and Assembly provide additional funding for rental arrears to supplement the Emergency Rental Assistance Program (ERAP). The Senate provides an additional $389 million and the Assembly provides an additional $385 million.

Federal funding for rental arrears in the Emergency Rental Assistance Program (ERAP) was not sufficient to meet the need and countless more tenants have failed to make rent payments since. Further, tenants in subsidized and public housing were deprioritized during the process and need access to funds. In an analysis of 49,121 units, NYHC found about 31% are in arrears owing more than 2 months of rent. We support a a $2 billion Tenant Fund for Affordable Housing (TFAH), which would prioritize affordable and public housing.

Housing Access Voucher Program:

Both Houses provide $250 million for the Housing Access Voucher Program (HAVP) – which wasn’t which would provide rental assistance to families and individuals who are at risk of – or are already experiencing homelessness.

NYHC strongly supports HAVP. This program would provide stability to tens of thousands of low-income renters and put New York on track to end the homelessness crisis in our state.

Public Housing:

The Senate provides $400 million in capital for public housing – $350 million for NYCHA and $50 million for public housing authorities outside of NYC.

NYHC supports capital and operating support for NYCHA. However, they are facing significant rental arrears and would benefit from TFAH.

Supportive Housing:

Both one-house bills have maintained important supportive housing funding from the executive budget, including $128 million for the Homeless Housing and Assistance Program (HHAP), $210 million for the Empire State Supportive Housing Initiative Program (ESSHI), and $50.8 million for Homeless Housing and Preventive Services (which includes Solutions to End Homelessness Program, New York State Supportive Housing Program, Operational Support for AIDS Housing Program).

Homeownership:

Both Houses provide $40 million for the Homeowner Protection Program (HOPP).

The Senate provides an additional $100 million for a Mitchell Lama Preservation and Homeownership Program.

The Assembly provides significant additional investments in affordable homeownership including:

- $500 million for a new statewide limited equity cooperative program called Foundation for Futures to establish permanently affordable units for households at or under 130 percent AMI

- $250 million for Homeownership Funds to support investments in community land trusts, conversion of rental housing to homeownership housing, and tenant and tenant organization ownership of housing accommodations

- $100 million for a new First Time Homeowner Assistance program, which would provide assistance for down payments and closing costs to low and moderate-income people purchasing their first home

- $50 million for a Homeowner Stabilization Fund

Social Housing:

The Senate provides $50 million for land banks and community land trusts and the Assembly provides $10 million for land banks. Both houses provide $1 million for a community controlled affordable housing program.

NYHC supports restoration of funding proposed in one-house bills for existing HCR programs. Additional support for housing assistance for people experiencing homelessness and those with arrears in public and affordable housing are also critical to ensuring housing stability for thousands of low-income New Yorkers and for the financial stability of subsidized housing.