Albany’s final budget was over a month late but with the delay came some unexpected wins for housing, strongly supported by the New York Housing Conference. In addition to new capital to support zoning reforms passed in the City of Yes for Housing Opportunity, the final budget creates a $50 million pilot Housing Access Voucher Program (HAVP) and passes the Affordable Housing Retention Act – both top legislative priorities for NYHC.

New York is in a dire housing crisis and faces an unprecedented attack on affordable housing and broader antipoverty measures from the federal government. While more is always needed, we are pleased to see Albany moving forward to keep New York’s tenants housed and think creatively about how we address existing preservation challenges.

Housing Access Voucher Program Pilot (ELFA – Part HH)

The final budget includes $50 million for a four-year pilot of the Housing Access Voucher Program (HAVP) that would provide rental assistance for individuals and families at 50% AMI or lower and experiencing homelessness or at imminent risk of losing their housing.

HAVP is a huge victory for low-income renters across the state after many years of advocacy. We thank all of our partners in the Housing Access New York coalition, and WIN for their leadership on this issue. NYHC will push for permanency of this program.

Affordable Housing Retention Act (ELFA – Part GG)

The final budget includes language to return the condo conversion threshold to 15 percent for certain mixed-income rental buildings in New York City with expiring affordability requirements. In exchange, the expiring affordable units would be conveyed to a qualified nonprofit and have their affordability preserved permanently, and in some cases increased while creating affordable homeownership opportunities. The bill also requires a dedicated capital fund for repairs and improvements of the affordable units.

At minimum buildings must have 100 units and be built after 1996 with income-restricted rental units that are either at risk of expiring affordability restrictions or are permanently affordable but require additional support to remain viable. In some cases, the number of affordable units will be increased to ensure that at least 20% to 30% of units remain income-restricted in perpetuity.

The language reinforces tenant protections under rent stabilization, eviction protections and creates a pathway for existing tenants of the income-restricted rental units to work with the nonprofit owner to carry out a tenant opportunity to purchase by creating a permanently affordable cooperative.

For a more detailed explanation of the provisions see this summary from Nixon Peabody.

NYHC supports this proposal spearheaded by Habitat for Humanity NYC & Westchester to create a vehicle to both prevent the loss of expiring affordable units and expand affordable homeownership opportunities.

Housing Supply

$1.025 Billion in Capital is provided to support the City of Yes to be programmed in the following:

- $500 million for new construction of affordable housing

- $200 million for New York City Housing Authority (NYCHA)

- $80 million for Mitchell-Lama preservation

- $50 million for a mixed-income revolving loan fund in NYC

- $50 million to the New York Housing for the Future Program for low- and moderate-income families:

- $25 million for homeownership

- $25 million for rental

- $50 million for construction or preservation of supportive housing:

- $30 million for adults, youth, or young adults leaving the criminal justice system

- $20 million for seniors

- $50 million to address lead, mold and asbestos

- $30 million for mold and asbestos remediation

- $20 million for lead abatement

- $20 million for an affordable housing relief fund to address capital needs, emergency repairs and hazardous conditions in 100 percent affordable housing

- $25 million to rehab vacant NYCHA units for occupancy.

Governor Hochul’s commitment of State funding was critical to helping secure a deal on City of Yes zoning reforms and NYHC strongly supports this funding.

Redevelopment of Underutilized Sites for Housing (RUSH) (Capital, Urban Development Corporation)

$250 million in capital funding for the RUSH program for re-developing underutilized sites on state owned land for housing.

Supporting Pro-Housing Communities (Capital & Aid to Localities)

$100 million included for a Pro-Housing Supply Fund would assist Pro-Housing Communities by addressing critical infrastructure needs related to new housing such as water and sewer upgrades.

$5.25 million in new grant funding will offer technical assistance to communities looking to design and adopt pro-housing policies.

Hundreds of communities across the state have applied for Pro Housing Communities certification. NYHC supports funding carrots (we would also support sticks for localities failing to add housing).

$50 Million Mixed-Income Revolving Loan Fund (Capital)

to spur mixed-income rental development outside of NYC.

NYHC strongly supports this funding. The final budget does not include programmatic language, but this proposal is similar in concept to a program in Maryland and a bill introduced by Senator Rachel May to establish a revolving loan fund to finance mixed-income projects.

Double New York State Low Income Housing Credits (SLIHC) (Rev – Part D)

from $15M to $30M per year through 2029.

NYHC is supportive of increasing SLIHC even further to better meet the need.

Expand New York State Historic Tax Credit (Rev – Part E)

by decoupling from the Federal credit and removing census tract eligibility requirements for affordable housing with at least a 30-year regulatory agreement. Previously the law required recipients of a state historic tax credit be the same taxpayer as the recipient of the equivalent federal credit and limited eligibility for the tax credit to census tracts at or below the state median family income.

NYHC strongly supports this change to remove barriers to affordable housing development and allow this tool to be used to bring affordable housing in higher income neighborhoods.

Increased Funding for Supportive Housing (Capital & Aid to Localities)

A $17.8 million increase to the New York State Supportive Housing Program (NYSSHP) will help preserve about 9,000 NYSSHP units that are at risk of going offline. Funding for the Homeless Housing and Assistance Program (HHAP) is increased to $153 million – up from $128 million, and the Empire State Supportive Housing Initiative (ESSHI) received a per-unit rate increase from $25,000 to $31,000 and $34,000 in the NYC metro area.

Expanding supportive housing must remain a top priority to reduce New York’s record levels ofHomelessness Comptroller DiNapoli’s recent report shows the state’s homeless population doubled in just 2 years. We are pleased to see significant increases in resources for affordable housing, though it falls short of the needs identified by the Supportive Housing Network of New York.

Maintaining Affordability

Shelter Arrears Eviction Forestallment (SAEF) (Aid to Localities)

$10 million for SAEF to continue providing emergency rental assistance grants to localities outside of NYC.

Increase Access to Insurance Captives

$5 million in funding to support nonprofit affordable housing owners join an insurance captive.

Reduce Shelter Rent Taxes for Mitchell-Lama Residents (ELFA – Part L)

To help address escalating increases in insurance, utility, and taxes, the final budget

reduces the share of local property taxes paid by Mitchell-Lama developments in NYC from 10% to 5% of the annual shelter rent or carrying charges and allows the rest of the state to opt-in to this reduction.

The financial stability of many Mitchell-Lama buildings continues to be a concern especially with growing capital improvement needs and rising operating costs. This proposal will have tax implications for NYC.

Expanding and Preserving Homeownership

Provide $50 Million for Starter Home Innovation Funding (Capital)

to support innovative approaches to homebuilding such as the use of factory-built and modular development and incentivize the building of more starter homes.

Disincentivize Bulk Purchases of Homes by Institutional Investors (Rev – Part F)

by creating a 90-day waiting period in which they cannot bid on single- and two-family homes.

The bill defines institutional investors as an entity or group that owns 10 or more single- or two-family homes, manage or receive funds pooled from investors and acts as a fiduciary with respect to one or more investors; and have $30M or more in assets. Entities that are funded by these investors would also be subject to the waiting period except for nonprofits, land banks and community land trusts. Violations would be subject to up to $250,000 in penalties.

The bill would prohibit institutional investors from claiming interest and depreciation deductions from these homes unless sold to an affordable nonprofit or individual buyer who will live there.

The bill also includes language to strengthen cease and desist zones where homeowners can opt in to prevent being solicited to sell their homes by requiring the Department of State to provide public notice to homeowners in the zone for maximum awareness. The DOS would be required to at minimum publish notice on their website and annually in a local newspaper within the area of the zone.

NYHC strongly supports these legislative changes.

Create an Affordable Homebuyer Tax Incentive (ELFA – Part K) The final budget excluded the Governor’s proposal for an opt-in homebuyer tax incentive between 25 and 50 percent of the assessed value of a real property that is sold to a low-income buyer and subject to a regulatory agreement with a governmental entity, nonprofit, land bank, or community land trust. This would create a path for localities to assess taxes that more accurately reflect the true market value of subsidized homes. However, Governor Hochul indicated she secured and agreement to address this issue and similar legislation recently passed both houses to allow an opt-in between 25 and 75 percent of assessed value, so we expect her to sign it.

Funding for Other Housing Programs

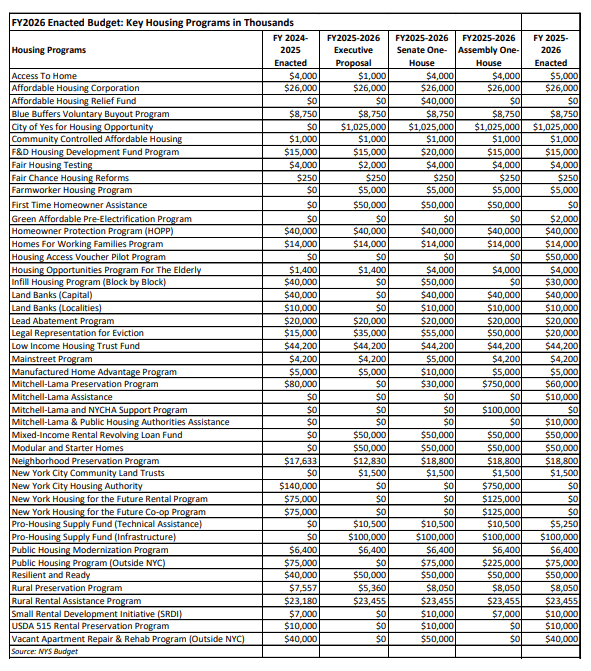

The final budget restores funding to key existing HCR programs, supports the ongoing 5-year housing plan and adds funding for several new initiatives noted above. However, the $427 million capital increase in the “housing program” is not actually additional funding but rather replaces funds used to cover a lapse in the state’s debt authority last year. New and existing housing programs can be viewed in the table below. Note that NYCHA and Housing for the Futures show as $0 because those are included in the broader City of Yes funding: