Governor Hochul recently released her 2026 Executive Budget Proposal, which continues investment in the five-year statewide housing plan, and includes additional policy proposals and new funding to support housing supply, affordability and expand opportunities for homeownership. The budget bills can be viewed here.

Housing Supply

$1.025 Billion in Capital to Support the City of Yes (Capital)

$25 million is dedicated to rehabbing vacant NYCHA units for occupancy. The remaining $1 billion broadly supports development and preservation of affordable housing including, multifamily rental, homeownership, NYCHA and Mitchell-Lamas.

Governor Hochul’s commitment of State funding was critical to helping secure a deal on City of Yes zoning reforms. NYHC strongly supports this funding. Notably, the funding is spread over 5 years. The needs of NYCHA and Mitchell-Lamas could easily take up a majority of this allocation if these programs don’t receive dedicated funding in the final budget.

Supporting Pro-Housing Communities (Capital & Aid to Localities)

A $100 million Pro-Housing Supply Fund would assist Pro-Housing Communities by addressing critical infrastructure needs related to new housing such as water and sewer upgrades.

$10.5 million in new grant funding is proposed to offer technical assistance to communities looking to design and adopt pro-housing policies.

Hundreds of communities across the state have applied for Pro Housing Communities certification. NYHC supports funding carrots (we would also support sticks for localities failing to add housing).

$50 Million Mixed-Income Revolving Loan Fund (Capital) to spur mixed-income rental development outside of NYC.

The Executive budget does not include programmatic language, but this proposal is similar in concept to a program in Maryland and a bill introduced by Senator Rachel May (S00733) for a revolving loan fund to finance mixed-income projects.

Double New York State Low Income Housing Credits (SLIHC) (Rev – Part D) from $15M to $30M per year through 2029. The bill also clarifies that refunded bonds can be paired with SLIHC at the same 9% rate as certain federal low-income housing tax credits.

NYHC is supportive of increasing SLIHC even further to better meet the need.

Expand New York State Historic Tax Credit (Rev – Part E) by decoupling from the Federal credit and removing census tract eligibility requirements for affordable housing with at least a 30 year regulatory agreement. Currently the law requires recipients of a state historic tax credit be the same taxpayer as the recipient of the equivalent federal credit and limits eligibility for the tax credit to census tracts at or below the state median family income.

NYHC strongly supports this change to remove barriers to affordable housing development and allow this tool to be used to bring affordable housing in higher income neighborhoods.

Encourage Redevelopment of Vacant Properties by strengthening municipalities authority to acquire vacant, abandoned and blighted properties and expanding the 485-r tax exemption to incentivize redevelopment. The bill would:

- Strengthen municipalities authority to acquire vacant and abandoned buildings by amending the criteria to find that a vacant dwelling is abandoned. (ELFA – Part J)

- Expand the existing tax exemption (485-r) for redevelopment of inhibited property to include all localities and one to four unit buildings that are not owner-occupied. (ELFA – Part M)

485-r currently only allows a city with a population between 15,000 and 15,500 to opt into the exemption for single-family, owner occupied properties. They may exempt redevelopment inhibited property from taxation on its increased value due to demolition, alteration, rehabilitation, or remediation for up to 25 years.

NYHC supports this legislation to encourage redevelopment.

Streamline Environmental Review for Modest Housing Development by allowing certain multi-family housing no more than 10,000 square feet to move forward as “Type II” actions which do not require review under SEQR. This is a regulatory change from the Department of Environmental Conservation that is completing its rulemaking process.

NYHC supports this rulemaking change and seeks further SEQR reform.

Increased Funding for Supportive Housing (Capital & Aid to Localities)

The Governor proposes increasing funding to the Homeless Housing and Assistance Program (HHAP) to $153 million – up from $128 million, increasing the Empire State Supportive Housing Initiative (ESSHI) to $240 million – up from $210 million and increasing Homeless Housing and Preventive Services (HHPS) to $71.3 million – up from $53.581 million. At least $56.3 million of that must be allocated to the New York State Supportive Housing Program (NYSSHP).

Expanding supportive housing must remain a top priority to reduce New York’s record levels of homelessness. Comptroller DiNapoli’s recent report shows the state’s homeless population doubled in just 2 years.

Maintaining Affordability

Increase Access to Insurance Captives

In her State of the State, the Governor proposed funding to provide assistance to nonprofit affordable housing owners to make repairs or take other steps needed to meet eligibility standards for participation in an insurance captive.

This funding was not included in the Executive budget bills but we anticipate inclusion later in the budget process.

Captive Insurance for Public Benefit Corporations (TED – Part NN)

The bill would authorize certain state and local authorities to create a pure or captive insurance company, would expand the definition of an industrial insured group to include certain state and local authorities and establish guidelines on formation and administration of any captive insurance companies. It would also allow public benefit corporations, public authorities, and other public entities to incorporate as a group captive insurance company.

This language was not highlighted in the State of the State or budget briefing materials.

Reduce Shelter Rent Taxes for Mitchell-Lama Residents (ELFA – Part L)

To help address escalating increases in insurance, utility, and taxes, the Governor proposes to reduce the share of local property taxes paid by Mitchell-Lama developments in NYC from 10% to 5% of the annual shelter rent or carrying charges and allows the rest of the state to opt-in to this reduction.

The financial stability of many Mitchell-Lama buildings continues to be a concern especially with growing capital improvement needs and rising operating costs. This proposal will have tax implications for NYC.

Ban Collusion Using of Algorithm-Enabled Rent Price Fixing (ELFA – Part H)

To protect tenants from rent increases driven up artificially by real estate management software, the bill would make it illegal to either facilitate or enter into an agreement between residential rental property owners or managers to not compete, including not competing by adjusting rents or occupancy levels based on recommendations from algorithmic devices that analyze data from multiple owners or managers.

NYHC supports this effort.

Extend Security Deposit Protections to Rent-Regulated Tenants (ELFA – Part I)

2019 laws require the return of remaining security deposits within 14 days of vacating the unit and allow tenants to request an inspection to determine what needs to be remedied to receive a security deposit back in full. Rent-regulated tenants were erroneously left out and this bill would remedy this oversight.

NYHC supports this legislative change.

Expanding and Preserving Homeownership

NYHC supports Governor Hochul’s proposals to expand and strengthen homeownership.

Provide $50 Million for Starter Home Innovation Funding (Capital) to support innovative approaches to homebuilding such as the use of factory-built and modular development and incentivize the building of more starter homes.

$50 Million for First-Time Homebuyers’ Down Payment Assistance (Capital) to help low to moderate income New Yorkers save for down payments

Create an Affordable Homebuyer Tax Incentive (ELFA – Part K)

The bill proposes an opt-in homebuyer tax incentive between 25 and 50 percent of the assessed value of a real property that is sold to a low-income buyer and subject to a regulatory agreement with a governmental entity, nonprofit, land bank, or community land trust.

Disincentivize Bulk Purchases of Homes by Institutional Investors (Rev – Part F) by creating a 75-day waiting period in which they cannot bid on single- and two-family homes. The bill defines institutional investors as those who own 10 or more single- or two-family homes and have $50M or more in assets. Entities that are funded by these investors would also be subject to the waiting period except for nonprofits, land banks and community land trusts. Violations would be subject to $250,000 in penalties.

The bill would also prohibit institutional investors or their individual owners from claiming interest and depreciation deductions from these homes unless sold to an affordable nonprofit or individual buyer who will live there.

Strengthen Laws and Policies to Combat Home Appraisal Discrimination (ELFA – Part G)

Makes discrimination based on protected classes unlawful in real estate appraisals and allows fines up to $2,000 for violations.

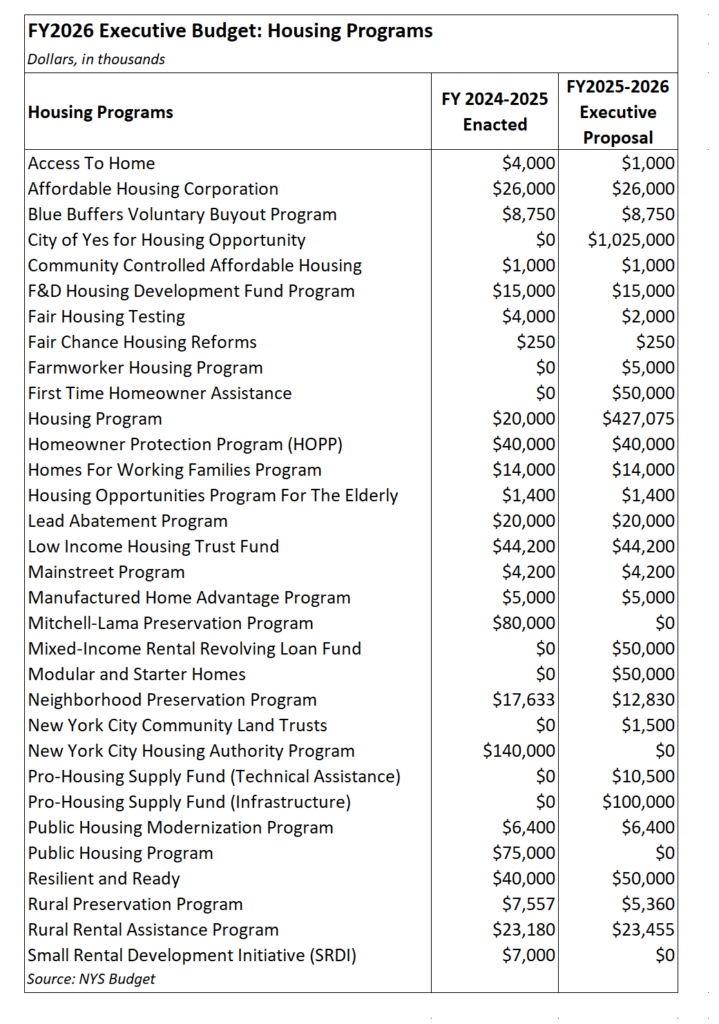

Funding for Existing Housing Programs

The Executive Budget supports the ongoing 5-year housing plan and adds funding for several new initiatives noted above. However, the $427 million capital increase in the “housing program” is not actually additional funding but rather replaces funds used to cover a lapse in the state’s debt authority last year.

NYHC supports expanding investment in the housing plan and opposes decreased funding levels for the Neighborhood and Rural Preservation Programs and the Small Rental Development Initiative which the Executive proposes to cut. We expect the Legislature will advocate for full restoration, as they have in past years.