On Tuesday, Governor Cuomo gave his State of the State address in Albany and released his FY2020 Executive Budget, outlining his priorities for the current legislative session. Here is what we currently know about the Executive Budget and the Governor’s legislative priorities for housing.

NYS Homes and Community Renewal (HCR) has been reappropriated $2.9 billion. This includes funds in the Governor’s 5-year, 100,000-unit Housing Plan originally appropriated in FY2017 and other previously appropriated housing funds. Reappropriations allow continued spending of previously allocated funds. Some previously allocated funds are intended for multi-year expenditures or future year expenditures. For example, $500 million appropriated at the start of the housing plan is authorized for spending in the upcoming fiscal year.

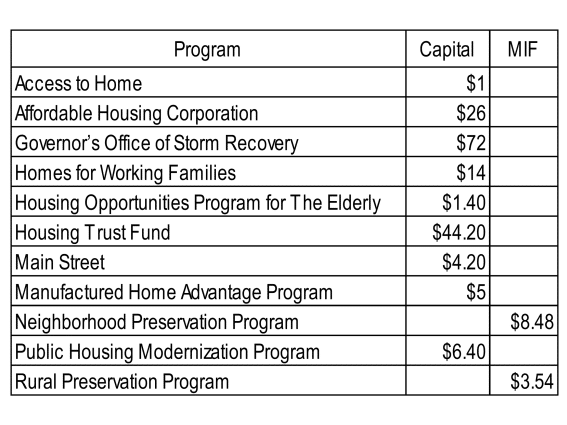

HCR is allocated $174 million in new funding in the capital budget, although $72 million of this is for the Governor’s Office of Storm Recovery, not HCR’s affordable housing programs. Another $12 million is funded from the Mortgage Insurance Fund excess reserves (MIF) for housing programs listed below.

The Executive Budget reappropriated $450 million previously allocated to NYCHA for critical capital repairs. This includes $200 million appropriated in FY2018 and $250 million in FY2019. While the Executive Budget reappropriates the funds, it does not provide any indication of how these funds will be released in the future. With concerns of inadequate oversight, Governor Cuomo signed an Executive Order last spring requiring a state monitor to oversee spending of state-allocated NYCHA funding. Subsequent to the Executive Order, a settlement agreement between NYCHA and the US DOJ was announced with plans for a federal monitor. The Governor indicated that a federal monitor could oversee funds in the place of a state monitor. In December, the settlement agreement was rejected by the court and a new plan is now being negotiated by NYCHA and HUD.

Given the current state of limbo of a potential federal monitor, Governor Cuomo and the Legislature should come to agreement on terms to release these funds to make critically needed repairs and upgrades, which are urgently required to improve heating systems. There are private sector models that can be utilized to oversee repairs.

Following this report, the Governor is expected to provide legislation for the “the Rent Regulation Act of 2019.” The Executive Budget also provides funding of $8 million to come from the OHP-rent administration program this year, and an additional $8 million in FY2021 to be spent only if the legislature has enacted the “the Rent Regulation Act of 2019”.

The HCR report, which will inform the Executive’s rent law bill, shall include: (i) the number of rent stabilized housing accommodations within the City of New York; (ii) the number of rent stabilized housing accommodations outside the City of New York; (iii) the number of rent controlled housing accommodations in the City of New York; (iv) the number of rent controlled housing accommodations outside the City of New York; (v) the number of applications for major capital improvements filed with the Division; (vi) the number of units which are registered with the Division where the amount charged to and paid by the tenant is less than the registered rent for the housing accommodation; (vii) for housing accommodations that are registered with the Division where the amount charged to and paid by the tenant is less than the registered rent for the housing accommodation the average of the difference between the registered rent for a housing accommodation and the amount charged to and paid by the tenant; (viii) the number of rent overcharge complaints processed by the division; (ix) the number of final overcharge orders granting an overcharge.

New legislation also proposes to limit the amount of security deposit that a landlord may charge a tenant to an amount or value not in excess of two months’ rent, including the first month’s rent. In addition, Governor Cuomo will issue regulations prohibiting state-funded housing operators from automatically turning away applicants with poor credit or histories of bankruptcy. Instead, the State will require that all potential tenants and homeowners be holistically evaluated to determine the circumstances behind their credit history and their ability to pay rent on a forward-looking basis. State-funded developers of rental housing will also be required to offer tenants the option to have their rent payments reported to credit bureaus at no cost to the tenant, which will enable tenants to help build a credit history.

SALT & HOMEOWNERSHIP

The Governor emphasized the cost of the federal Tax Cuts and Jobs Acts of 2017 to New York, which drastically curtailed the State and Local Tax (SALT) deduction to 10%. This will cost taxpayers upwards of $14.3 billion annually. New York filed a lawsuit against the federal government arguing that the new SALT cap was enacted to target New York and similarly situated states, that it interferes with states’ rights to make their own fiscal decisions, and that it will disproportionately harm taxpayers in these states. Last year, the state had created charitable funds as a way to avoid the SALT cap but were struck down by the IRS in August. However, the state’s Alternative Employer Compensation Expense Program (ECEP) established last year is still available. While individuals face the SALT cap, businesses do not, and this is one of the partial work-arounds companies can opt in to in order to cut the personal income tax on wages and ensure that State filers subject to the ECEP would not experience a decline in take-home pay.The Governor is once again calling for property tax cap to become permanent. Since the implementation of the tax cap in 2012, growth has averaged approximately 2 percent and the tax cap has produced approximately $25 billion in taxpayers’ savings.

Notably the Executive budget did not include funding for foreclosure prevention. The inclusion of $20 million for the Communities First proposal is one of NYHC priorities in Albany this year.