The New York State Senate and Assembly each released their budget bills today with major implications for affordable housing. The Legislature will negotiate with Governor Cuomo to come to agreement on a budget by April 1st.

We are grateful to Assembly Speaker Carl Heastie, Senate Leader Andrew Stewart-Cousins and Housing Chairs Steven Cymbrowitz and Brian Kavanagh for including so many of our budget priorities this year. There are also new revenue proposals included in the budget bills, which could address insufficient resources for public housing or tackle homelessness. However, the Legislature also seeks new prevailing wage requirements, which are far above market rates. This will significantly drive up the cost of affordable housing and greatly diminish production.

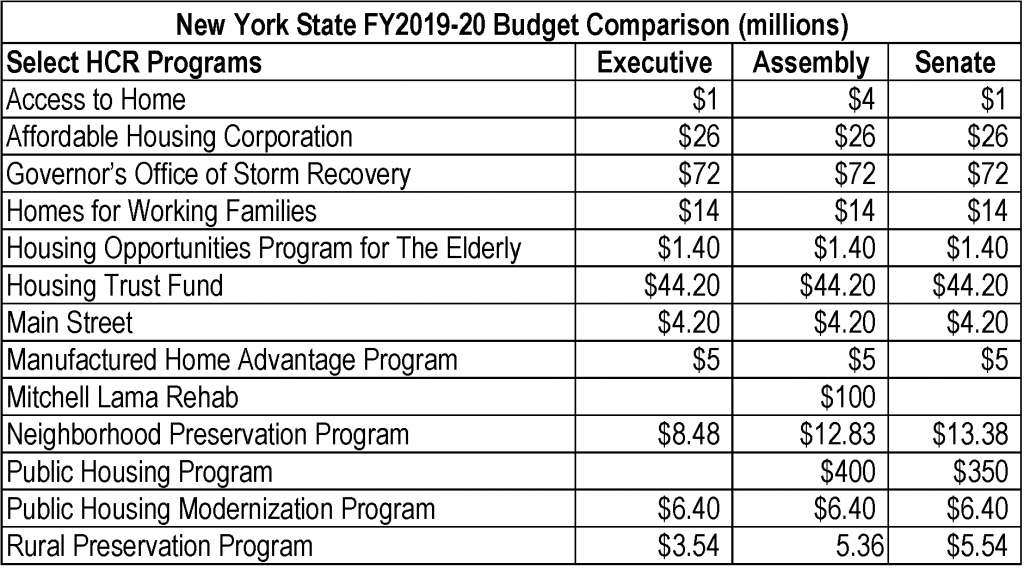

Here is our preliminary analysis:

LEGISLATURE SUPPORTS MANY OF NYHC PRIORITIES

Notable differences between the one house bills and the Executive Budget are the Legislature’s support for public housing, Mitchell Lama, Neighborhood and Rural Preservation Programs, foreclosure counseling, Home Stability Support and the 2020 Census. NYHC has been working in partnership with other organizations across the state on many of these issues.

Public Housing- The Assembly budget allocates $300 million for NYCHA and $100 million for public housing outside of NYC. The Senate allocates $250 million for NYCHA and $100 million outside of NYC. While these amounts are less than the $500 million called for by the Coalition for Capital Investment to #SAVENYCHA, we are grateful to the Legislature for making public housing a priority.

Communities First- $20 million is provided for housing and foreclosure counseling in both bills. With previous funds from AG settlement monies expected to run out this month, communities and low- and moderate-income homeowners will benefit the extension of these services. NYHC is part of the Coalition for Affordable Homes and a strong supporter of Communities First.

New Home Stability Support Program- We thank the Legislature for proposing new housing resources to combat homelessness. This new program, starting in April 2020, would provide 14,000 new shelter supplements statewide to prevent eviction and address homelessness. The Senate funds this initiative at $20 million but the Assembly provides $100 million, $40 million of which can be used this fiscal year.

Census Funding- $40 million has been allocated for 2020 Census outreach funding across New York State by both the Senate and Assembly. This is a smart investment as there is much to lose in an undercount. NYHC is a proud member of the NY Counts 2020 Coalition.

NEW PREVAILING WAGE REQUIREMENTS

Both the Senate and Assembly propose new prevailing wage requirements for both construction and building service workers. These costly requirements are certain to significantly reduce production of affordable housing. NYHC opposes new prevailing wage requirements and will provide cost impact in the upcoming days.

Construction Prevailing Wages

The proposed expansion of prevailing wages has an extremely broad definition of public subsidy in both bills based on the definition found in A1261/S1947-Bronson/Ramos with a few exceptions including one for construction performed on a multiple dwelling where at least 75% of the residential units are affordable for households earning up to 60% AMI. However, this does not go far enough in excluding a wide range of mixed income projects financed by the City and State from these requirements. The Senate is aware of our opposition and included this in their bill:

“The Senate believes prevailing wage should be paid on projects supported by public dollars. However, the Senate acknowledges legitimate concerns by various stakeholders and supports all stakeholders coming together to negotiate a mutually agreeable outcome. The final proposal should recognize regional cost differentials among the state, recognize the unique nature of Industrial Development Agency and Local Development Corporation incentives, ensure development in all regions of the state continues, preserving opportunities for MWBEs, and preserve the development of affordable housing.”

NYHC advocates for an exemption of all projects with at least 35% of units affordable under regulatory agreement.

Building Service Workers

The Legislature also proposes that any development project in New York City that has received or is expecting to receive public agency financial assistance or are projects with public agency lease agreements must pay no less than prevailing wages to all building service employees in connection with the covered development project or covered leases. This includes employers and subcontractors who employ building service workers at covered sites. Depending on the type of financial assistance provided the amount of buildings covered under this requirement could be expanded. If the assistance is provided to a particular building, facility or locality then the prevailing wage requirement is limited to those specifically. However, if the financial assistance isn’t as limited, it could apply to any building or facility the covered developer operates within the state. The requirements for prevailing wage for covered properties, developers, and leases shall apply: for the term of the financial assistance, for 10 years from the date it covered project opens, or the duration of the written agreement or covered lease, whichever is longer.

This requirement would be impossible to implement in many existing affordable housing projects and would especially burden supportive housing with higher staffing needs required to keep formerly homeless disabled individuals and families stably housed.

NEW REVENUE PROPOSALS

Transfer Tax

There hasn’t been much discussion of the Mansion Tax this year but the Assembly has revived a proposal. Additional transfer tax will be imposed at increasing rates for properties of $5 million or more starting at .3% of sales value and going up to 1.5% for conveyances over $1 billion. NYHC is in full support of a mansion tax and recommends that revenue from luxury sales be redirected to tackle our housing crisis.

Pied-à-Terre Tax

Recent comments in the press indicate Governor Cuomo’s willingness to consider this new tax on non-primary residences and both the Senate and the Assembly has responded with legislation in their budgets. The legislation allows NYC and other large localities to establish a pied-à-terre tax on properties valued at $5 million and greater for a new tax based .5% -4% of market value. Market value will be based on a comparable sale-based valuation method, as determined by the department of finance. It is expected that this tax could generate upwards of $600 million annually.

NYHC recommends that part of any new annual revenue be dedicated to meeting NYCHA’s capital needs. We are also advocating for renewal and reform of the coop/condo abatement that could achieve the same goal.

RENT REGULATIONS AND OTHER POLICY ISSUES

While Governor Cuomo provided support for some rent reforms in his budget and promised a report from HCR to inform legislation, the Legislature wants to take up this issue after the budget. Here are some other policy issues worth noting:

- Source of Income Discrimination- Regrettably, both Senate and Assembly budgets failed to include new measures to prevent source of income discrimination, which would increase housing opportunity across the state. NYHC has been advocating for this protection for rents as part of the #BanIncomeBias campaign.

- Security Deposits- The Executive budget capped security deposits for renters to 2 months but the Senate proposes negotiating this issue after budget.

- Historic Rehabilitation Tax Credit- Both the Senate and Assembly made their own modifications to the Governor’s Historic Rehabilitation Tax Credit proposal regarding the rehabilitation of historical properties on state-owned land.

- Foreclosure Settlement Conferences- The Senate advances language to make permanent policies requiring lenders to issue a 90-day pre-settlement conference notice before foreclosing on all home loans and requiring mandatory settlement conferences for residential foreclosure actions for all home loans.

- Property Tax Cap. A top priority for the Governor is to make permanent, a property tax cap, limiting growth to 2% per annum or the rate of inflation, whichever is less. While the Senate has already passed Legislation, the Assembly is holding out, perhaps to gain leverage in budget negotiations.

While we expect the budget to be negotiated by April 1st, Governor Cuomo has stated that without a permanent property tax cap, there is no budget deal. Even with a Democratic major, negotiations are going to be tough this budget season. There is much to be gained and much to lose with so many new policy proposals which would impact housing. New York Housing Conference will continue to advocate for affordable housing priorities and keep you informed on key policy issues.