DOGE’S CHAINSAW

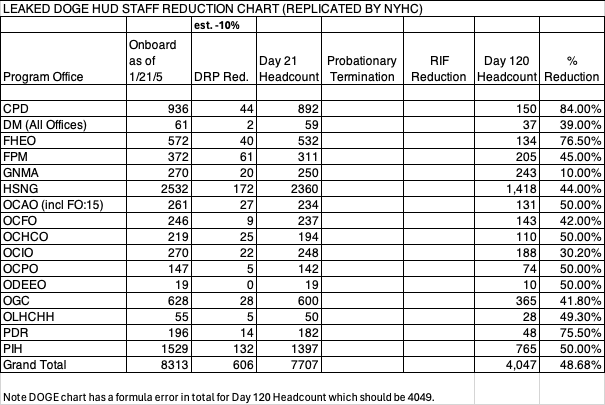

In a leaked memo, a

plan was revealed to reduce HUD staff by 50%, from 8,313 staff to 4,047. Provisional staff (606 of them) have already been fired and the next targets are GS13 civil service level and below. Program areas would face steep losses, which are sure to impact HUD-assisted households and affordable housing development. Even if

the HUD budget is somewhat protected, the staff reductions will clearly impact HUD’s ability to get funding out and run programs. This is a major concern.

For example, the Office of Community Planning and Development oversees the Continuum of Care,

HOME, CDBG and disaster recovery among other programs is slated to be reduced by 84% or 786

workers. The Office of Housing overseeing FHA, multifamily housing and RAD among other programs will

be reduced by 44% or 1114 staff. The Urban Institute discusses the impact on lending here. It seems like

with staff reduction plans of the scale the intent could possibly be to consolidate or eliminate field offices.

DOGE is reporting on “savings” without many details. HUD claims to have recovered $1.9 billion of

“misplaced” funds and $260 million in additional savings.

There are also awards that seem to be withheld for the Green Retrofit and Resiliency Program (GRRP)

which is funding upgrades in HUD assisted projects, including many in NY. HUD has also failed to issue

funding on new 202 awards.

Under DEI executive orders, HUD has also moved to cancel technical assistance contracts under Section 4.

Enterprise Community Partners, LISC and Habitat for Humanity are typically grant recipients.

Yesterday HUD Secretary Turner terminated the Affirmatively Furthering Fair Housing (AFFH) rule calling it a “zoning tax”.

Budget Reconciliation Moves One Step Forward

The House of Representatives narrowly passed a budget resolution 217-215, laying out the

framework for a sweeping tax package to extend the Trump tax cuts set to expire in December, drastically

cut spending and achieve other policy priorities for President Trump. The resolution calls for $4.5 trillion in tax cuts and at least a $2 trillion reduction in spending over a decade.

Reconciliation is a process separate from annual appropriations that allows Congress to bypass the

filibuster and pass big spending packages by a simple majority if they meet certain restrictions. However,

both the Senate and the House must adopt the same bill to move forward and there has been

disagreement between the two chambers on the approach to passing policy priorities through this

method. The Senate wants to pass two reconciliation bills and has already passed a competing budget

resolution focused on energy, military and the border with the intention to extend tax cuts later in the year.

In the House version, instructions to the House Financial Services Committee which covers housing calls

for $1 billion in cuts. It is important to note that Financial Services covers HUD but also includes many

other areas, such as the CFPB which has been a target of White House. CFPB budget over ten years is

more than $800 million, potentially a large share of the targeted savings.

Over the next weeks and months, there will be intense negotiations in Washington. The federal

government is currently running on a continuing resolution until March 14. The debt ceiling limit will be hit in April. The last debt ceiling agreement called for appropriations bills to be passed to raise it again.

The FY2025 Senate bill calls for proration of Section 8 budget by 97.5% ($141M cut for NYC), meaning

thousands of the Section 8 vouchers in NY will be at risk. While the House bill calls for even steeper cuts

with proration of the Section 8 budget at 88.6% ($357M cut for NYC), public housing cuts of 5% to the

capital budget and 6% to operating and cuts to the HOME program at 2/3 the current budget. Both bills

propose cuts to the Tenant Protect Vouchers which support NYCHA’s preservation through both PACT

and the Public Housing Preservation Trust, representing an 11% cut for NYC. If appropriations bill are passed, they will fund the fiscal year through September. If House Republicans can get votes for one big bill, they hope to pass it in May and there could be impacts in FY2025. Otherwise, the Senate’s approach to leaving a tax bill for later in the year will prevail.

We are likely so see cuts to housing but we do not yet know about budget impacts for this

fiscal year or what types of cuts HUD may face moving forward and timing is unclear. NYHC will be

monitoring the potential impact of funding uncertainty on affordable housing closings this spring.