On March 31st, the New York State Budget for FY 2018-2019 was approved. The $168.3 billion enacted budget includes $250 million in new appropriations for NYCHA. The final budget also included re-appropriated funding for the 5-year Statewide Affordable Housing Program. Last year, Governor Cuomo and the Legislature passed a budget funding a $1.97 billion 5-year affordable housing plan that more than doubled historic capital levels. The re-appropriated funding will allow for the program’s continued implementation and the building of housing units statewide. We would like to thank Governor Cuomo, Assembly Speaker Heastie and Senator Majority Leader Flanagan and all members of the Legislature for their continued support and investment of affordable and public housing in NY.

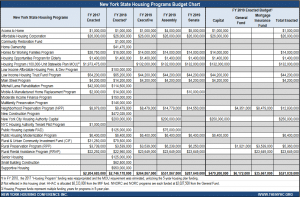

For full details, click on chart below to see NYHC Analysis of NYS 2018-19 Budget.

Other budget highlights include:

Additional $250 million NYCHA Capital Investment for Emergency Repairs

This new $250 million allocation combined with $300 million previously appropriated by the State to NYCHA and Mayor de Blasio’s $200 million commitment this year will allow for some substantial progress to be made to restore safe and healthy housing conditions for NYCHA residents. More funding is needed, but we are happy to see the State and City providing this down-payment to remediate some of the emergency conditions at NYCHA.

New NYCHA Oversight Measures by State Statute and Executive Order

The budget amends public housing law section 402d to allow the Governor to enact a oversight plan for the funding, which he did on Monday when he signed an Executive Order creating a new independent monitor, who will oversee the spending of the $550 million that the State has appropriated to NYCHA over the past three years. The monitor’s title will be Independent Emergency Manager and must be unanimously selected by the Speaker of the City Council and the President of the NYCHA Citywide Council of Presidents (CCOP) in consultation with the Mayor within 60 days. If the three stakeholders are unable to come to an agreement in their selection, the City Comptroller would step in and have two weeks to make the appointment. The monitor would create a comprehensive emergency remediation plan and then have 30 days to bid out and select an independent contractor to perform the work. In addition to the State now regulating how its State capital funding is spent, HUD decided last week that it must approve all draw-downs from NYCHA’s federally allocated capital funds. These additional layers of spending oversight could affect the speed of repairs.

Expediting NYCHA Repairs Using Design-Build

The FY 2019 Budget includes design-build authorization for NYCHA’s repairs, the construction of new jails to replace the Rikers Island Jail Complex, and the reconstruction of the Brooklyn Queens Expressway. As a result of design-build authorization, the City will avoid significant delays in construction and will realize savings in excess of $1 billion.

SLIHC/LIHTC Bifurcation and Certification Amendment

The budget added a provision to allow for the bifurcation and certification of State Low Income Housing Credits (SLIHC) and federal Low Income Housing Tax Credits (LIHTC) permitting credits to be decoupled allowing investors in a project to transfer state credits independent of federal credits. A taxpayer allowed a state low income housing credit now will be able transfer the credit, in whole or in part, to another person or entity, without regard to how any federal low income housing tax credit may be allocated. Furthermore, the other person or entity would not need to own interest in the eligible low-income project. However, the transfer must be approved by the Commissioner of HCR and a transfer contract be made. This will make SLIHC credits more attractive to investors, which will create additional demand and drive up pricing as competition increases, thereby translating into additional equity for SLIHC projects.

No Temporary Deferral of Affordable Housing Tax Credits including State Low Income Housing Credit (SLIHC), Brownfield and Historic Credits

The Executive Budget had proposed a deferral of the usage of most business credits for tax years 2018 through 2020, where such credits exceed $2 million. This would have negatively impacted credit pricing and caused delays in permanent financing. We are excited to see that the Legislature decided against this proposal.

NY State Tax Code Adjusted to Circumvent Tax Reform’s State and Local Tax Deduction (SALT) Cap

The recently enacted federal tax law has negative fiscal implications for many New Yorkers. By gutting the deductibility of state and local taxes, the law effectively raises middle class families’ property and state income taxes by 20 to 25 percent. New York is fighting back by decoupling the state tax code from the federal and creating two New York charitable contributions funds that New Yorkers can donate to in order to claim a State tax credit equal to 85 percent of the donation amount for that tax year. Also, the State would allow employers to opt-in to a payroll tax that can pass on to its employees to allow them to avoid personal income tax since full State and local tax deductibility for individuals was taken away by tax reform, but it was not for businesses. The IRS could challenge these changes.

Continue the Local Property Tax Relief Credit

The Property Tax Credit, enacted in 2015, will provide an average reduction of $380 in local property taxes to 2.6 million homeowners this year alone. By 2019, the program will provide an additional $1.3 billion in property tax relief and an average credit of $530.

Outreach and a Comprehensive Homeless Services Plan Required from Each Local Social Services District

The FY 2019 Budget requires all local social services districts develop and implement an approved outreach and services plan to address street homelessness.